Park Lawn Corporation (TSX:PLC)

Investment idea in a boring and fragmented industry. Growth and serial acquirer. Keep an eye on debt and SBC.

1.Introduction to Park Lawn Corporation (TSX:PLC).

Park Lawn Corporation is a Canadian-owned funeral, cremation and cemetery provider.

In 1892, Park Lawn Company Limited was established with Park Lawn Cemetery in Toronto. In 2002, Park Lawn acquired the assets of Westside Cemeteries Ltd. from Service Corporation International. This acquisition increased the portfolio to 6 cemeteries in Toronto.

And it was not until 2013 that Park Lawn began their history of acquisitions and current growth. In each year since 2013 Park Lawn has acquired numerous small businesses.

Park Lawn has a history of being a fast-growing company in the industry in North America. Since 2013 PLC has grown to a diverse portfolio of properties and businesses operating across Canada and the US.

Currently company continues its strong growth both organically and through acquisitions. According to the last Annual Report, Park Lawn had:

Canada: 25 Stand-alone funerals, 5 stand-alone cemeteries and 1 on site (British Columbia, Ontario and Quebec).

U.S: 115 Stand-alone funerals, 104 stand-alone cemeteries and 34 on site (Colorado, Georgia, Illinois, Iowa, Kansas, Kentucky, Michigan, Mississippi, Missouri, Nebraska, New Jersey, New Mexico, North Carolina, South Carolina, Tennessee, Texas, Virginia, Wisconsin and Wyoming).

It is practically impossible to keep up to date with all the small acquisitions that the company makes. In the web site today Park Lawn indicate the following:

2.Business model

Park Lawn Corporation, together with its subsidiaries, owns and operates cemeteries, crematoriums, and funeral homes in Canada and the United States. The company primarily offers cemetery lots, crypts, niches, monuments, caskets, urns, and other merchandise, as well as funeral, after life celebration, cemetery, and cremation services.

Currently, Park Lawn operates in micro markets with an entrepreneurial and adaptable business model and is exposed to markets with dense populations (Toronto, Denver, St. Louis, Nashville, Houston, New Jersey), as well as traditional markets (Mississippi, Kentucky, North and South Carolina, and Georgia).

Organic growth strategy.

The Company’s growth strategy includes organic initiatives, the optimization of product and service offerings, a focus on streamlining and improving its operational efficiencies, and future acquisitions which align with the Company’s culture. Organic initiatives include:

the build-out of inventory at new or existing cemetery properties

remodeling of existing funeral homes

construction of new stand-alone funeral homes

construction of new funeral homes on existing cemetery properties

These projects unlock new sources of revenue for existing businesses while increasing the useful life of PLC's existing portfolio by allowing certain facility, personnel, and equipment costs to be shared between funeral service and cemetery locations.

Inorganic growth strategy.

The Company’s growth strategy is based on acquiring leading independent businesses in both new and existing markets. Currently acquisitions in high growth markets are being at a rate of $75-$125 million per year. Acquisitions are carried out through the cash flow of the business, debt and equity issuance.

3.Management Team.

The management team has extensive experience in the funeral and cemetery sector.

I summarize its two main figures (CEO and COO):

J. Brad Green (CEO, since June 2020).

Mr. Green has over 16 years of experience in the funeral and cemetery profession. Before, Mr. Green served as a founder, owner and the CEO of Signature. Prior to founding Signature, he was the Executive Vice President and General Counsel of another publicly traded funeral and cemetery industry consolidator (Carriage Services NYSE: CSV). During that time, he was responsible for many corporate functions, including acquisitions.

Jay Doods (COO, since May 2018).

Mr. Dodds has over 40 years of experience in the funeral and cemetery profession.

He holds a funeral director’s and embalmer’s license. In addition, he is a certified cremation operator. Mr. Dodds served as founder, owner and President/COO of Signature. Prior to founding Signature, he was the Executive Vice President and COO of another U.S. publicly traded deathcare company (Carriage Services NYSE: CSV) where he served for 17 years.

Bradley Green has only 0.14% of the company's shares, and Jay Woods is not known to me to have shares. I would like them to align their interests with the company by owning a significant level of shares.

Personally, this should give us an additional level paying attention to issues such as:

review the debt management and review the possible issuance of shares to acquire companies are made in good or bad times.

valuation of the price paid for acquisitions.

ensuring that value creation and the progressive improvement of margins are more important than growth.

4.Main transactions undertaken since 2016 and performance in the markets.

Since 2016, Park Lawn has a history of important acquisitions.

Since January 2016, Park Lawn has posted a total return of +122%. Comparatively, the S&P/TSX Composite Index posted a +55% total return over that same period.

Park Lawn plans to continue its acquisition growth strategy where opportunities are attractive and can be integrated with existing operations or provide entry to a new high-growth market. Investment levels in acquisitions are important (currently 75-125 million).

Number of acquisitions and investments in acquisitions in recent years.

Characteristics of the companies to be acquired:

Very small companies out of the radar of large players (few competitors).

The sector is characterized by being companies run by older people without continuity of family transition.

Companies can be acquired at good valuation multiples and then, once integrated, be valued better.

Based on all the experience acquired by Park Lawn, the operation of the acquired companies can be optimized.

The Internal Rate of Return (IRR) for expansion initiatives, which is established by the directive, is a target IRR 20%.

5.Death Care Industry

In 2022, the market size of funeral homes in the United States was estimated to be just over 19 billion U.S. dollars. This is a significant increase of roughly three billion U.S. dollars since 2021 and indicates the largest annual growth between 2015 and 2022.

Below I include a chart of the industry landscape obtained from Annual Report of Park Lawn Corp.

It should be noted that it is a very fragmented market full of small independent companies. Roughly 80% of funeral home and cemetery locations in the U.S. and Canada are independently owned and operated.

Global market for death care services will grow by 6,1% year on year during the period 2022-2030. And the global market for the funeral homes and funeral services is forecast to post a CAGR of 5.9%.

The rising population of adults aged 55+ will provide many opportunities for the funeral homes and cemeteries with respect to pre-need sales and planning. The increasing death rate accompanying this large population increase will provide opportunities for growth in at-need sales. (Image obtained from Park Lawn Annual Report).

More families are choosing cremation due to its affordability when it's time to navigate death's financial toll. Over the last 15 years, the U.S. cremation rate nearly doubled to 57%, according to industry data.

Affordability has driven the surge of cremations over the last 40-50 years. About 60% of Americans are living paycheck to paycheck, according to data from LendingClub, and household debt hit a record high in 2022. So, when the people faced with an emergency expense like a death, the selected option is the lowest-priced option.

For a cremation with a funeral service and viewing, the average cost is $6,970, compared to $7,878 for a funeral with viewing that also includes burial, according to a 2021 study by the National Funeral Directors Association. Families choosing cremation have two options: direct cremation or cremation with services. Direct cremation means the body is taken directly to the crematory, and ashes are returned to the family without a service or visitation. It’s the cheapest and most common cremation arrangement in the U.S. The average cost for direct cremation is $1,000 to $3,000, depending on whether you use a funeral home or crematory. A cremation with services includes cremation along with a memorial service, similar to a traditional funeral. The family can have an urn with the deceased’s ashes present in lieu of a casket. The cost of this cremation option ranges from $1,500 to $4,000. For a viewing and service, consumers can expect to pay upwards of $6,000, with preparation of the body, embalming, a casket and staffing included among the additional costs.

Park Lawn operate in markets with high cremation rates (Toronto, New York, New Jersey, Colorado, and New Mexico), as well as low cremation rates (Mississippi, Kentucky, North and South Carolina, and Georgia). Park Lawn is the #1 player in cremations in Toronto, conducting >50% of cremations performed in the market. (Image obtained from Park Lawn Annual Report).

6.Main figures of the business.

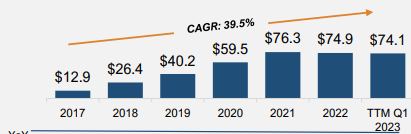

Revenues ($M):

Net earnings ($M):

Adjusted EBITDA ($M):

Adjusted Net Earnings ($M) and Adjusted Net Earnings per Share ($M):

Capital deployment (Maintenance & growth capital):

7.Plans, future, and expectations.

As indicate above, the death care industry continues to be a highly-fragmented market.

Park Lawn's operating philosophy is to grow 70% through acquisition opportunities and 30% through organic growth.

In 2018, the Company announced its aspirational growth target to reach C$100 million in pro-forma Adjusted EBITDA by the end of 2022, which it has exceeded. In doing so, the Company has achieved the following significant milestones:

An increase in market capitalization from C$566M to C$817M

Growth in Adjusted EBITDA attributable to PLC shareholders from $18.7M to $74.9M, an increase of 302%

Adjusted Net Earnings Per Share growth of 80.0% to $0.98 in Adjusted Net Earnings Per Share

Improvement in Adjusted EBITDA Margin by 140 bps to 22,5-23.0%.

This is the Park Lawn’s 2026 aspirational growth target:

Inorganic growth. Continue to acquire leading independent businesses in both new and existing markets and obtain the necessary financing to complete such acquisitions. Select the best option to complete acquisitions (the issuance of shares, debt,…). The completion of acquisition opportunities in high-growth markets at a rate of $75-$125 million per year.

Organic growth. continue doing investments in individual businesses to achieve organic growth and in projects and initiatives which yield improved asset productivity, including mausoleum developments, the development of existing and new cemetery properties, and development of on-site funeral homes.

Create value in past acquisitions.

Continue to capitalize on ongoing operational improvements to both existing and acquired businesses through the full implementation, deployment and integration of PLC’s proprietary industry software.

Achieve greater market share penetration in the markets the Company currently operates.

Target IRR of over 20% on expansion initiatives.

Improve the business margins.

PLC has set an aspirational growth target of achieving a total of US$150M of pro forma Adjusted EBITDA by the end of 2026 translating into Adjusted Net Earnings exceeding US$2.00 per share.

Adjusted EBITDA - 14,5% CAGR From 2021 to 2026

Adjusted Net Earnings per Share - 10,6% CAGR From 2021 to 2026

8.Advantages and tailwinds for the company.

The main scenario on which I visualized the growth, and the creation of value is the following:

High growth operator in a stable and highly fragmented industry.

An aging population across North America provides favorable demographic characteristics.

Fragmentation that allows plugins that prove economies of scale.

Margin expansion opportunities through increased scale and operating efficiencies.

High barriers to entry due to zoning laws - particularly in cemeteries - and pricing pressure on smaller operators.

Conservative capitalization facilitates further growth through acquisition.

A promising acquisition pipeline should provide a foundation for continued growth, and ongoing portfolio optimization should also yield continued improvements in ROIC.

9.Balance sheet strength.

[Excuse me for this information-dense section, but I think it is the company's main risk].

In the sector in which it operates, companies usually have Net Debt/Ebitda ratios from 2,5x to 4,5x.

Park Lawn → Net Debt/Ebitda Ratio = 3.

Service Corporation International → Net Debt/Ebitda Ratio = 3,5.

Carriage Services → Net Debt/Ebitda Ratio > 5.

Park Lawn (Debt/Adjusted Ebitda)

Debt costs are rising and have already affected the latest results.

Finance costs increased by $686,637 for the twelve month period ended December 31, 2022, compared to the same period in 2021 as a result of $65,357,678 more debt outstanding on the Company’s Credit Facility year-over-year. On December 31, 2022, the interest rate on the Credit Facility was 5.2% compared to 1.1% on December 31, 2021.

Liquidity and Capital Resources

The Company’s principal sources of liquidity are cash provided from operations and from the issuance of debt and equity instruments. Investment income from the Care and Maintenance Trust Funds are used to defray eligible cemetery care and maintenance expenses. The Company had a net working capital of $27,625,754 as of December 31, 2022, including $30,277,742 in cash.

The Credit Facility has an overall borrowing capacity of $240 million and a maturity date of August 31, 2027. In January 2023 Commencing February 21, 2023, in order to provide the Company additional financial flexibility, Park Lawn added a $60 million tranche to its existing credit facility for a term of one-year.

The Credit Facility requires the Company to maintain a Leverage Ratio of less than 3.75 times and an Interest Coverage Ratio of greater than 3 times. The Company’s Leverage Ratio and Interest Coverage Ratio will fluctuate depending on its earnings, interest rates and the amount of its outstanding debt. As of December 31, 2022, the Company was in compliance with both covenant tests with the Leverage Ratio being 1.83 times and the Interest Coverage Ratio being 21.79 times.

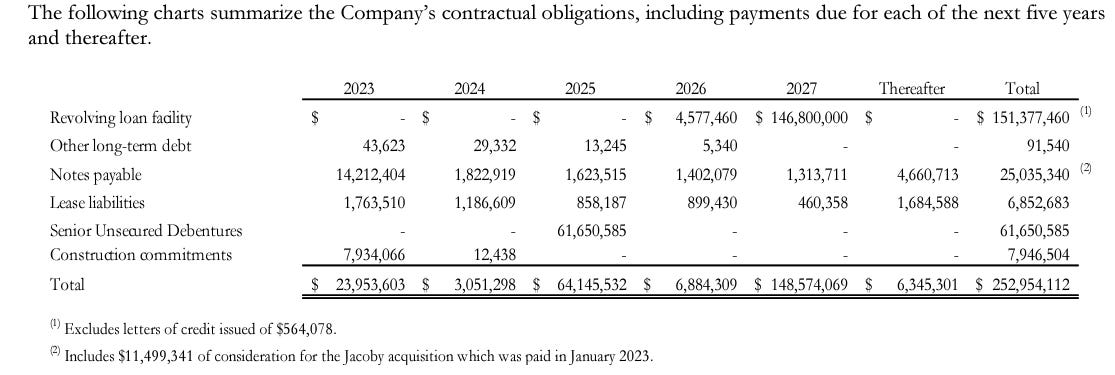

At December 31, 2022, the Company had $151,941,538 outstanding on the Credit Facility. The Company has an undrawn balance on its Credit Facility of $88,058,462 and $30,277,742 in cash on hand as at December 31, 2022.

Through the 2021 Financing, the Company raised total gross proceeds of C$148,548,400, which were used to repay outstanding indebtedness under the Credit Facility and for strategic growth initiatives including acquisitions, organic growth opportunities and general corporate purposes.

In July 2020, the Company raised C$86,250,000 in gross proceeds from the issuance of publicly traded Debentures. The proceeds were used to repay a portion of the outstanding Credit Facility. For purposes of testing the covenants under the Credit Facility, the Debentures are not included as part of total indebtedness. The Debentures mature on December 31, 2025 and are not redeemable before December 31, 2023.

As at December 31, 2022, the Company had other debt of $25,126,880 comprised of vehicle loans and notes payable to former business owners supporting non-compete and warranty agreements. Further, the Company had $5,763,281 in lease liabilities, and the Debentures balance as at December 31, 2022, was $61,650,585, net of debt issuance costs and accretion expense of $1,934,086. Included in notes payable is $11.5 million that was paid to the former business owner in January, 2023.

Effective February 27, 2023, the Company, through one of its subsidiaries, entered into an interest rate swap transaction with one of the Company’s syndicate lenders of the Credit Facility, whereby, the parties agreed to exchange at specified intervals, fixed and variable interest amounts calculated by reference to a notional amount of $50 million. The term of the interest rate swap is three years with a variable to fixed interest rate swap arrangement at 4.372%.

Management believes that cash from operating activities, future debt financings, and the Credit Facility will be sufficient to support the Company’s ongoing business operations, growth initiatives and debt repayment obligations. The Company’s cash on hand will fluctuate depending on its revenues, timing of receivables, and inflationary pressures resulting in increased expenses and interest rates. Growth through organic initiatives, the optimization of product and service offerings, a focus on streamlining and improving its operational efficiencies and strategic acquisitions may necessitate the raising of funds through debt, equity financings and/or other means. Decisions will be made on a specific transaction basis and will depend on market and economic conditions at the time.

Contractual obligations due by period. The following charts summarize the Company’s contractual obligations, including payments due for each of the next five years and thereafter.

10.Consolidated statements of earnings.

Brief comment and image of the consolidated statements of earnings.

Revenues up 11% year to year (Sales continue to grow despite having exceeded the exceptional sales of the year of covid 2020).

Finance costs increased by $686,637 (+9%) for the 12 month period ended 2022.

General and administrative costs increased by $27,382,690 (+21%) for the 12-month period ended 2022.

Share based compensation increased by $832,630 (+22%) for the 12 month period ended 2022.

11.Consolidated statements of cash flows.

Free cash flow is used for company acquisitions. Acquisitions of companies are complemented by an increase in debt or issuance of shares (whatever is most convenient at any given time).

The acquisitions of companies are consolidating the business, increasing ebitda, increasing net income, increasing free cash flow…. And by owning more assets and a bigger business, he can access more debt to continue acquiring businesses. This is what allows them to grow faster.

But it is necessary to control how much they earn for the companies they acquire (acquisition multiple) and what returns they obtain, so it is a key aspect to watch as investors. That is what will tell us if the growth is sustainable and creates value in the long term.

Currently the company is deploying a capital around of 90-100 M USD for company acquisitions. If we consider that the free cash flow is 45 M USD, the rest of the capital is debt or an increase in shares.

If the company stopped acquiring other companies and had to repay the debt with the free cash flow of the business, it would take about five years. It would be less time since newly acquired businesses take time to become efficient and give the expected cash flow. In addition, behind the consolidation of companies, there would be an increase in operational efficiency, access to new markets, improve margins,... But we must have an order of magnitude.

Below is an image of the consolidated cash flow statements.

12.Valuation.

Valuation (Last Twelve Months):

Market cap (today) = 591 M USD

Revenues = 320 M USD (LTM)

Ebitda (adj.) = 75 M USD (LTM)

Net income = 25 M USD

Net Debt = 222,7 M USD

Free cash flow = 44,82 M USD (LTM)

Dividend 2% (I don't like the dividend when you're borrowing at medium interest rates or issuing stock).

Enterprise value/ Free Cash Flow = EV/FCF = 18,15

EV/EBITDA = 10,85

P/E = 23,60

NET DEBT/EBITDA = 2,97

%Net margin = 7,8 % (LTM)

Ebitda Margin = 22-23%

FCF Margin = 14%

2026 Valuation based on the guide:

Market cap (today) = 591 M USD

Revenues > 600 M USD

Ebitda (adj.) = 150 M USD

Net Debt = 412,5 M USD (Estimated Debt/Ebitda = 2,75)

Free cash flow = 80 M USD (Estimated 14,5% Margin FCF)

Dividend 2%.

EV/FCF 2026 = 12,54

EV/EBITDA 2026 = 6,70

Ebitda Margin = 25%

If a pricing study of the company is carried out, it can be seen that it would be reasonable to value Park Law at multiples of:

EV/EBITDA = 15x

EV/FCF = 20-22x [the minimum EV/FCF value of a benchmark company in the sector such as Service Corporation International “NYSE:SCI” was 20x in 2020 (reviewing information from 2013). SCI is a mature business, but Park Lawn is a small but growing Park Lawn business].

Therefore, I could estimate the value per share in the end 2026 at around 40-50 CAD/share. I know that the range is wide, but the uncertainty of the execution of the objectives and the clarity in the analysis factors are also wide. [Today's value is 22,95 CAD/share. At the time of making the article].

12.Last news.

A few days ago, Park Lawn Corporation confirmed that it has submitted a preliminary cash proposal to the Board of Directors of Carriage Services, Inc. (NYSE: CSV). Current management has worked at Carriage Services for many years and knows the value of Carriage Services. We'll see what happens in the future, but this would be doubling the size of the company.

"I have never specialised in economic forecasting or market forecasting either. My own business has largely been based on the principle that if you can make your results independent of any views as to the future you are that much better off." Benjamin Graham

This article is not a stock buy recommendation. (Company information has been obtained from annual reports and investor presentations).

Hola. Un placer leer la tesis, me ha parecido muy interesante, aunque aún no he analizado la compañía en profundidad. Aprovecho y te pregunto unas dudas que me han surgido sobre el análisis. Las SBC, ¿son tan altas por algún motivo puntual o suelen serlo? Para una empresa que gana 25 millones, que se pague casi uno en sbc me parece muy alto. Por otro lado, creo que hay una bajada en margen los últimos dos años. ¿Se sabe a qué se debe? Porque en teoría no deberían tener muchos problemas para trasladar los aumentos de precio en un negocio así. Y por último, parece un poco cara, ¿qué la convierte en mejor posibilidad que las otras dos acciones o que Propel, por ejemplo?

En fin, me pongo a mirar la compañía, cuando tenga conclusiones si estás interesado te las comparto, y de nuevo, felicidades por el análisis de una compañía que, a mí me ha resultado muy interesante