Rentokil Initial PLC (LON: RTO) (NYSE: RTO)

New leader of the US market (34%). A truly defensive sector. The scale as a defensive moat. Low cost business model. Pricing power. A great acquisition that requires patience. Discount vs peers.

1. Introduction to Rentokil Initial PLC.

Rentokil Initial PLC is the world's largest pest control company, offering the broadest, most advanced range of pest control solutions and services in the industry. The company also provides hygiene services, including the provision and maintenance of products. In addition, it engages in the supply and maintenance of workwear and protective equipment.

Rentokil Initial PLC is operating in over 90 countries, approximately 90% of its revenues are derived from outside the UK.

Rentokil started out as the idea of an entomologist, Professor Harold Maxwell-Lefroy, and has grown into the world’s leading commercial pest control services company and the most recognised brand in the industry.

A timeline about the company:

1903: Mr A. P. Bigelow introduced a towel rental service to businesses in London. Each towel was marked with the customer’s initials, which ensured that customers only received their own towels, leading to the name, ‘Initial Towel Supply Company’.

1906: Danish pharmacist, Georg Neumann of Aalborg discovered a strain of bacteria lethal to rats and mice, which became known commercially as Ratin. The first London sales office opened in 1906.

1920: Maxwell-Lefroy, Professor of Entomology at Imperial College London, was asked to study ways of exterminating Deathwatch beetles in Westminster Hall and in time began receiving regular orders.

1924: Maxwell-Lefroy started supplying bottles of woodworm fluid from a small factory in Hatton Garden, which he called ‘Ento-kill fluids’ – an amalgam of the Greek work ‘entomon’ meaning insect and the English word ‘kill’.

1925: Rentokil is born. The company was registered in 1925 as Rentokil Limited due to trade name objections preventing the name ‘Entokill’.

1928: The Initial Towel Supply Company floated on the stock market and during the 1930s.

1940: Demand for pest control services began extending beyond rodent control to insect control.

1946: Shortly after WW2 Reykjavik found itself overrun with both brown and black rats. Rentokil was called in to deal with the problem and within a few weeks, the rats were eradicated.

1957: By the mid-1950s, the synergies between British Ratin and Rentokil Ltd had become obvious and British Ratin acquired Rentokil Ltd and its service arm, Woodworm and Dry Rot Control Ltd.

1960: Rentokil Group Ltd. was adopted as the main title of the Company.

1962: On 1 January 1962 all the UK trading companies became divisions of Rentokil Laboratories Ltd, shortened to Rentokil Limited.

1964: Rentokil launched in Asia, through the acquisition of Anti Pest in Hong Kong and Fumigation & Pest Control in Singapore.

1965: Rentokil signed a 10-year contract with the City Fathers of Hamelin – the first since a certain Pied Piper had been called in 1284!

1966: Rentokil was awarded a contract to repel birds at Buckingham Palace and pest control at the newly opened Post Office Tower (BT Tower).

1969: Rentokil Group Ltd was listed on the London Stock Exchange with one of the largest new issues of shares the City had seen. In the same year, it established the basis of a hygiene division with the purchase of Rashbrooke Chemical Company and in 1970 acquired Thames Services for £1million.

1973: Rentokil was called upon to carry out termite treatment to the foundations of the newly completed Sydney Opera House.

1979: Rentokil secured a pest control services contract for the newly-built NatWest Tower in the City of London – at that time it was Britain’s tallest building.

1985: In the early 80s BET increased its stake in Initial to 40%, and in 1985 BET acquired the remaining 60%. This allowed it to merge Initial with Advance Service’s laundry operations while retaining the Initial brand name.

1987: Rentokil acquired Thomas Cowan and cemented its position as the leading pest control provider in Malaysia and Singapore.

During the 70s, 80s and 90s Rentokil embarked on geographical expansion. A healthcare division (now hygiene) was set up during this period.

1996: Rentokil made its largest acquisition to date, BET (British Electric Traction) and the Initial brand passed to Rentokil.

2007: Rentokil launched the world’s smartest mousetrap – RADAR – the Rodent Activated, Detection And Riddance device which combines CO2 and infrared technology. Rentokil Initial entered Asia’s fastest-growing economies of Brunei, India, and China.

Image made by Nikolett Emmert

2012: Operations expanded to new territories with acquisitions in Turkey, Brazil, Abu Dhabi and Dubai. In North America, the acquisition of Western Exterminator made Rentokil one of the largest players in the US pest control market.

2015: Rentokil made its 50th acquisition in the US – consolidating its position as one of the largest national pest control companies in the world’s biggest pest control market.

2017: Rentokil Initial forms a joint venture with PCI Pest Control. PCI’s operations in 250 locations and 6,900 colleagues join forces with the existing Rentokil team to become the biggest pest control service in India.

Rentokil launches Lummia a new generation of energy-efficient LED fly killers designed to attract, kill and encapsulate insects hygienically, eliminating the risk of contamination in hygiene-critical areas.

Rentokil Pest Control is awarded The Queen’s Award for Enterprise for International Trade, recognising the business’s outstanding achievement in global trade.

Source: Annual reports/Website.

2. Main sectors and regions of the business.

Main sectors of the business.

Pest control.

Rentokil Pest Control is the world’s leading commercial pest control company, operating in 90 countries. This is a growing global market and Rentokil is strongly positioned for growth with leading positions in the UK, continental Europe, Asia, Pacific and South Africa, and a rapidly expanding presence in North America.

Pest control is their priority category in acquisitions to increase density. Rising hygiene standards are driving greater demand for pest control in their markets, particularly in emerging economies.

Its key points of differentiation include the strength of its brands, international reach, innovative products and an excellent operating model. This is helped by their heavy investment in information technology, allowing them to serve customers better, faster and more efficiently. Rentokil maintains a strong portfolio of innovations to drive further growth and develop its leading technical capability. Its unique patented products underpin its differentiation.

Hygiene & Wellbeing.

Initial Hygiene is the world’s leading hygiene services brand with leading positions in 22 of our 60 countries. including Pacific, Asia, the Caribbean, Europe, the UK and Africa.

Rentokil provides provide high-quality hygiene solutions and services for washrooms, full premises and enhanced environments that minimise the risk of exposure to pathogens, micro-organisms, air-borne particles and harmful VOCs. This is a complementary business to Pest Control with compatible operational models and a strong profit contribution.

Initial offers a wide range of products including the new Signature and Reflection ranges, together with Colour and no-touch options as well as air purification, surface hygiene, floorcare and SmartHygiene. Their focus is on product and service quality to sell more services per customer; targeting higher-margin customers and increasing retention rates.

Rentokil achieves high levels of customer satisfaction and this is a key competitive advantage.

Workwear in France.

Initial Workwear in France specialises in the supply and maintenance of garments, such as workwear and personal protective equipment. Initial also offers a specialist cleanroom service for the pharmaceutical and healthcare sectors. This category has a complementary fit with Hygiene, benefiting from a shared brand, linked service and integrated route-based operations.

Source: Own elaboration

We can see how the company's strategy is advancing, focusing on the pest and hygiene market.

Main regions of the business.

Source: Annual Reports.

North America.

The world’s largest pest control market. Rentokil provide commercial and residential pest control services and sell pest control products. Rentokil also provide plants to enhance office environments. North America is a key focus for their acquisitive growth as they consolidate their national presence in pest control.

Europe & Latin America.

Renkotil provide pest control, hygiene, plants and, in France, workwear and textile services. Its largest operations are in France, Germany and Benelux. Other countries managed out of the Europe region include Austria, Switzerland, Italy, Spain, Portugal and Greece.

Its Latin American business is also managed through its European business with the support of our Spanish and Portuguese teams due to cultural and language similarities. Its businesses located in the Caribbean also report through South America.

UK & Sub-Saharan Africa.

In the UK Rentokil provide pest control, hygiene and plants services as well as a number of smaller specialist services including property care, medical and specialist hygiene. Other countries included in this region are Ireland, Estonia, Lithuania and several countries in Sub-Saharan Africa where we provide pest control, hygiene and plants services.

Asia & MENAT.

Rentokil offers hygiene and pest control services in many countries in Asia, including Malaysia, China, Indonesia, Philippines, Singapore, South Korea, Taiwan, Thailand, Vietnam and Brunei. They are the largest pest control service provider in India through a joint venture with PCI.

MENAT countries include Saudi Arabia, Turkey, Jordan and UAE where we provide pest control and hygiene services.

Pacific.

Rentokil provide pest control, hygiene services and plants in Australia, New Zealand and Fiji.

Source: Own elaboration

Location within the pest control industry.

Manufacturers: Bayer, Corteva, Syngenta, BASF, Sumimoto Chemical, JT Eaton.

Service providers: Rentokil, Rollins, Ecolab.

Software providers: Ratsense, Woodstream, Adams Pest Control.

3. Bussiness model.

Rentokil Initial has unrivalled expertise in the delivery of its route-based business model. Rentokil has a very clear target operating model: single-country management teams leading integrated, multi-service operations with combined back-office functions, all underpinned by common systems and processes such as route optimisation and measurement of customer satisfaction.

Rentokil Initial consider their business model as a “cog” where everything is correlated and is evaluated and controlled through periodic measurements at the group, business, country and branch level. The nature of its business model remains a key determinant of the company's strength and resilience. As a global operator benefiting from highly defensive product and service lines, the Company remains well positioned to navigate macroeconomic and geopolitical volatility.

Main characteristics of the business model.

Source: Annual Reports.

Operating model. Decentralised, single-country management teams.

This simple decentralised approach features single-country. Each country team leads integrated, multi-local and multi-service operations, using combined back-office functions underpinned by shared systems and processes, such as route optimisation, marketing and brand alignment, and measurement of customer satisfaction.

Focus on the customers. High customer retention, recurring revenues and pricing power.

They are a subscription-based business, servicing customers from the largest multinational pharmaceutical, industrial and food production companies to local shops, restaurants and homes.

More than 80% of revenues from service customers (rather than product customers) are protected by annual contracts. In most regions we are able to increase prices in line with inflation, while retaining high levels of customer retention.

As a services business, brand trust and identity matter. The company has two power brands in Pest Control – Rentokil and Terminix.

Focus in organic growth.

Organic revenue growth with new business and additional products and services. Focus on providing high levels of customer service on an ongoing basis through innovation and providing new products.

Organic growth continually drives improvements in business network density.

The strategy with regards to managing pricing and protecting margins involves carefully communicating cost challenges to your customers, ensuring their understanding of why the financial effects of inflationary cost pressures should be passed through into customer prices.

Focus in profits and margins growth with a low-cost model.

Your business model for profitable growth is focused on capitalization of income, profits and cash growth through organic growth and M&A. Revenue growth along with Their low-cost operating model allows them generate strong growth in the Group's profits.

The company has a fundamental understanding of route density, which helps them consolidate their positions in existing markets and improve margins, in part by focusing on increase the density of your routes, either through organic activity or by acquisition.

Focus on capital allocation model & returns

The company is a large cash generator and they work to maintain its balance sheet, allowing you the flexibility to reinvest in both innovation and M&A growth.

M&A Acquisitions are a core part of your business model, aimed primarily at city-focused deals to build presence and density in both Pest Control and Hygiene and Wellbeing

Another key objective is to generate long-term profitable growth to help deliver value and strong returns to shareholders. The Group is committed to maintaining its progressive dividend policy with dividend payments, twice a year, related to the level of Free Cash Flow available.

4. Main competitors and market share.

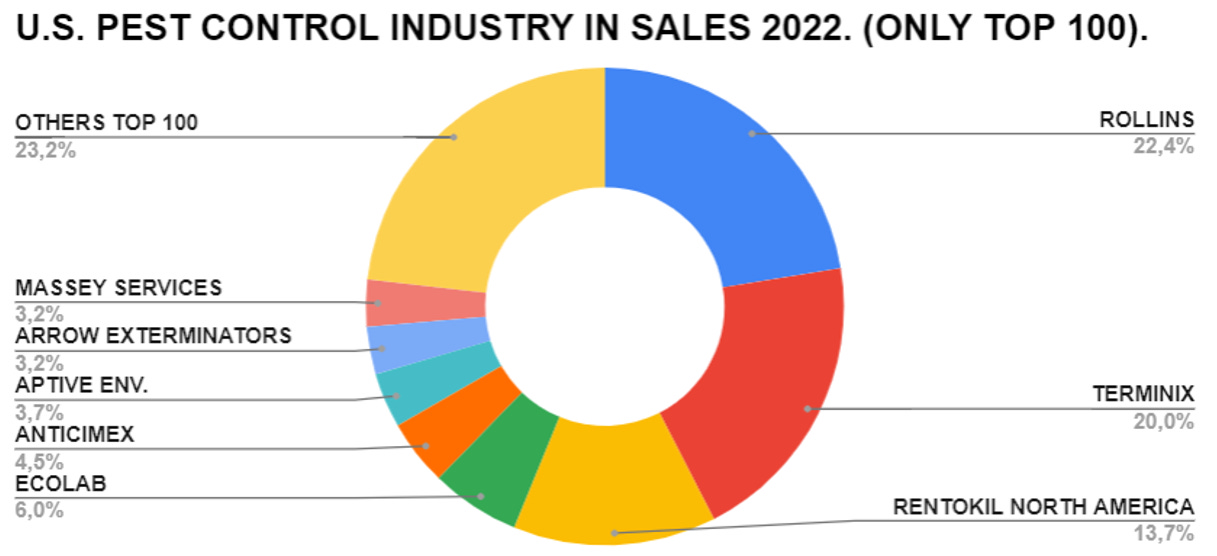

In this section and to try to focus on the most important business area, we will focus only on the pest market sector. And within the pest market sector, we will focus on the largest pest market in the world, North America. US accounts for c.44% (c.$10.5bn) of the global market.

Source: Own elaboration

In December 2021 Rentokil announced the proposed acquisition of Terminix for $55 per share in a largely equity financed transaction. The purchase will create the market leader in US pest control and adds 84% to Rentokil’s Pest Control revenue taking it to 75% of pro-forma 2020 revenue. Terminix has strong brand equity in residential and termite pest control which is highly complementary to Rentokil’s strength in commercial pest control.

In the graph above, only information from the United States is being included, but the three main companies (Rentokil, Rollins & Ecolab) compete globally and have large economies of scale compared to smaller companies.

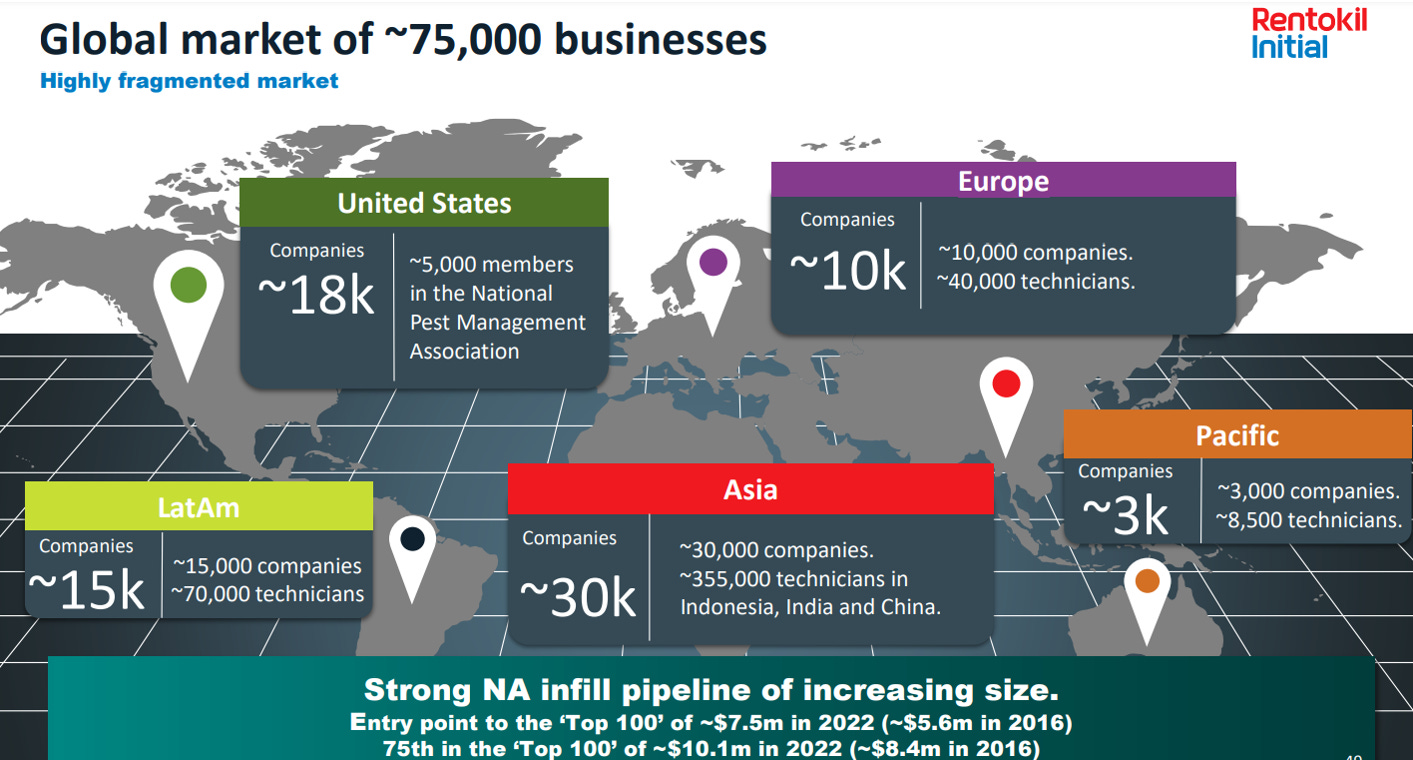

Rentokil competes in the highly fragmented termites, residential and commercial pest management markets. Key international competitors of Rentokil include Orkin (Rollins), Ecolab and Anticimex.

Global market of ~75,000 businesses. Highly fragmented market.

Source: Annual Reports.

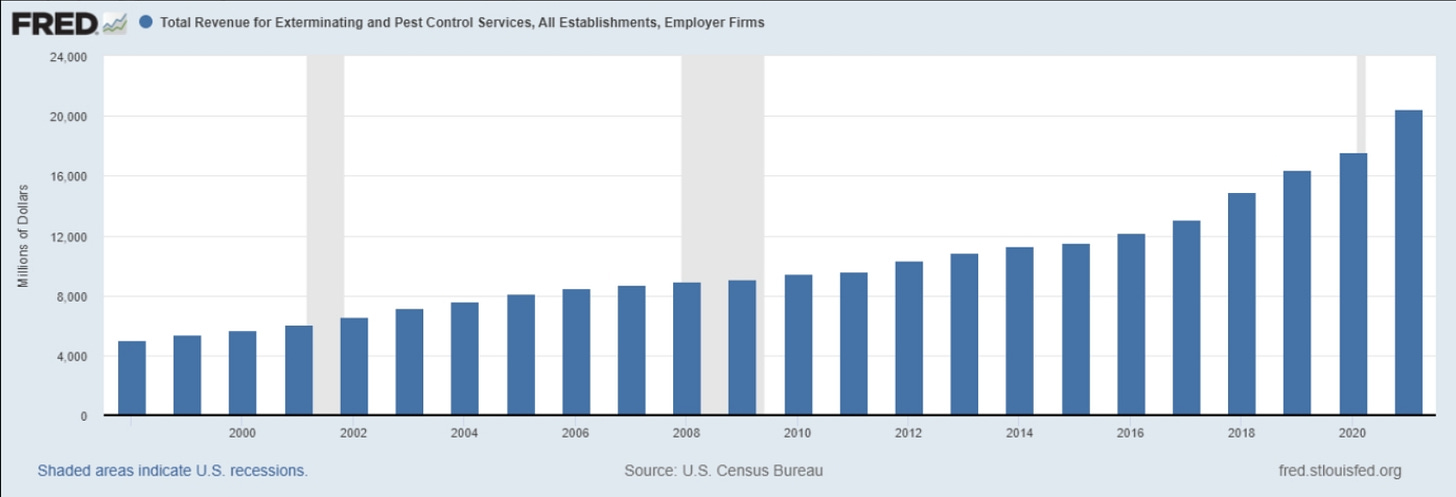

5. Industry growth trend.

The global pest control market is a strong, growing and attractive, non-cyclical market. It is highly fragmented with strong growth drivers fuelling medium-term growth across all regions.

The expected growth for the industry is included below:

Pest control global market worth c.$23.7bn per annum and is expected to continue to grow at c.5-6% annually to reach c.$31.4bn by 2027.

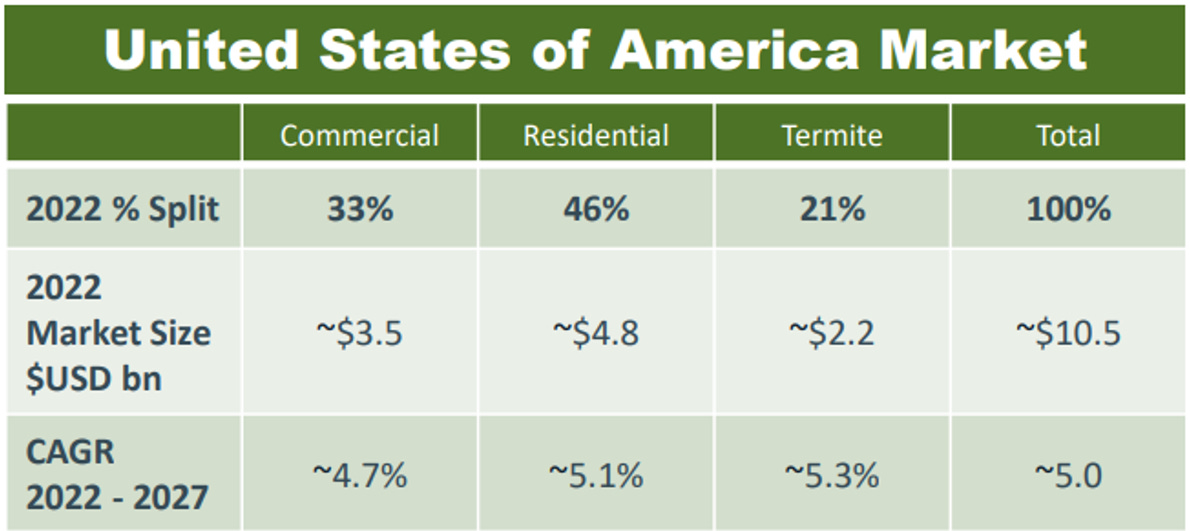

US accounts for c.44% (c.$10.5bn) of the market, maintaining a CAGR of c.5% to 2027, driven by strong residential and termite markets and its role as an essential service supporting ‘licence to operate’ businesses.

Rest of the World has a CAGR of c.6% to 2027, driven by higher growth in Emerging Markets and Cities of the Future

Structural growth drivers.

Growing population.

Rise of pests.

Vector-borne diseases.

Climate change.

Standards increasing - Food Safety Modernization Act. (both at the time of consumption and in the agricultural sector).

Increasing business pressure (reputational risk in bussiness as hotels, restaurants,..).

Increasing Pest Intolerance Driven by a growing expectations of middle classes.

Low residential penetration (less than 15% of homes in the US have professional pest care).

Customer Migration Continued migration to warmer, humid southern states with high pest pressure.

Regulatory Pressures Increasing role for innovation

Expanding Pest Footprint As pest move into new geographies there are increased risk in public health.

Expected growth of the global market by segments:

Commercial accounts for 50% of the global market.

55% of the global termite market is in the US alone.

Consistent growth across each segment globally.

Source: Annual Reports.

Expected growth of the US market by segments:

Residential is the largest segment of the US pest control market.

Pandemic benefited Residential as people spent more time at home.

US accounts for over 50% of the global residential and termite markets.

Source: Annual Reports.

6. Brief quote of competitive advantages

It is important to highlight that Rentokil is a business with several competitive advantages such as:

scale economics

good company culture

low-cost and customer-critical products

Source: Annual Reports.

7. Performance in the markets since 2000.

I have reviewed company information from the year 2000 to today. And we can say that we have two very different periods in terms of business management and business focus.

From 2000 to 2013, the company was a holding company with a wide variety of businesses (electronic security, surveillance and conferences, control pest, hygiene sector, package delivery business,..).

In that period, the company made several very bad acquisitions that generated large losses. Those acquisitions were made in sectors that had nothing to do with the pest management business. The business that generated the most losses and that led the company to a very delicate situation in 2008 was City Link (package delivery business).

From everything I have been able to read, the CEO between 2004 and 2008 (Brian McGowan) destabilized the company. McGowan was involved in the controversial 2004 ousting of previous chairman Clive Thompson, one of Britain's best-known businessman who was dubbed "Mr 20 Percent" for his record of increasing earnings by this amount when chief executive.

I add some quotes from the press and from the CEO of 2008.

February 2008.

“A second profit warning in as many months from British pest control and parcel delivery group Rentokil sent the shares plunging by more than a quarter to a 16-year low on 29 February”, said an analyst.

“The conglomerate, best known for its rat-catching roots, said profits this year would fall well below 2007 levels due to weak trading and management failings at its City Link parcel delivery business”, said an analyst.

"Credibility is clearly in tatters and the City Link debacle may herald the eventual break-up of the group in our view", said an analyst.

July 2008.

“Shares in Rentokil Initial plunged more than 30% on July 25, 2008, after the pest control and services group issued another profit warning, blaming failed acquisitions and a poorly executed business restructuring”, said an analyst.

"We continue to experience operational problems in a number of our businesses, virtually all of which originate from poorly executed restructuring or acquisition integration programmes initiated between 2005 and 2007" its CEO said at the time (Alan Brown. CEO – 2008-2013).

"It's not a good time to sell anything as far as I can see, unless you're into the fine art world. We should first of all improve our business before we secondly look at the portfolio", said Alan Brown.

“A third of the profit downgrade was due to the slowing economy and the rest to the poor integration of acquisitions and misguided cost-cutting plans by previous management”, said Alan Brown.

"We believe the current management team has over a decade of mismanagement to address and, while we feel there are decent underlying businesses in the group, the road to recovery is likely to be much longer than expected." said Alan Brown.

Rentokil Initial announced the sale of City Link after five years of substantial losses in 2013, and has already eliminated other unprofitable sectors.

Therefore, the company made the transition from a large conglomerate with very diverse businesses (electronic security, surveillance and conferences, Citi Link,…) to a company with the clearest focus on the most profitable market niche such as the pest control and hygiene sector.

And the market was quick to recognize the big changes towards a profitable company with high growth. Andy Ransom has been the CEO of Rentokil from 2013 to the present.

From mid-2012 to May 2023, the company had an increase in its share price of almost 800% (Without considering dividends).

Recently after a results warning after a large acquisition such as the company Terminix, Mr. Market has become nervous and the shares have fallen 35%.

8. The acquisition of Terminix. Mr. Market's concerns are now about the company.

On December 2021 Rentokil announced the proposed acquisition of Terminix for $55 per share in a largely equity financed transaction.

In October 2022, Rentokil completed the acquisition of Terminix, the largest pest control brand in the US, performing c.50,000 customer visits each day from c.375 locations across 47 states. The company paid an enterprise value – the combined value paid for Terminix’s equity and its net borrowings – of just over £4.5bn. In return, it got a business that was making annual operating profits of £173mn, according to FactSet data. It is a high price but it is a sector with high valuation multiples, and the company saw potential in optimizing synergies and being the market leader.

Terminix is the leading provider in the residential and termite sectors in the US, a market worth an estimated $10.5bn and expected to grow to c.$13.4bn by 2027, a CAGR of c.5%. It serves 2.9 million customers, with more than 80% of their services revenues recurring.

The acquisition brings together two highly complementary and synergistic portfolios creating the largest pest control operator in the US, the world’s largest pest control market, and a clear global leader in pest control.

The combination adds between 75%-80% to the size of Rentokil Initial’s Pest Control business in revenue, and is expected to be highly cash generative. The enlarged business will have a strong platform for growth, particularly in North America, and an attractive financial profile to support future growth, including through acquisitions and continued investment in innovation and technology.

This acquisition means that Rentokil now has more exposure to the North American market and the pest control segment. This acquisition has already been considered in section 2 when talking about geography and sectors of its sales.

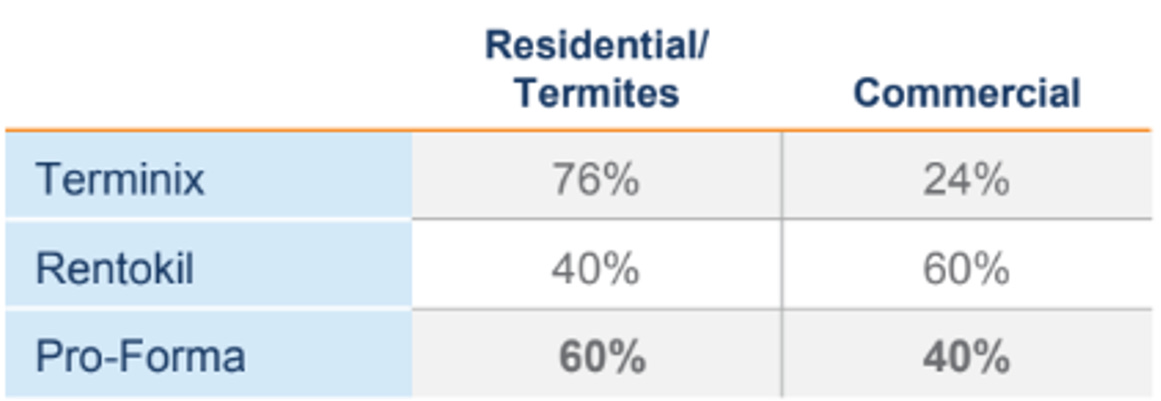

The specific scope of business will also vary within the pest control segment. Terminix has strong brand equity in residential and termite pest control which is highly complementary to Rentokil’s strength in commercial pest control.

North America mix bussiness:

Rentokil consider that there is a substantial opportunity to reduce the cost base of the enlarged group by investing to drive efficiencies, and by improving productivity to drive margin improvement through capitalising on the benefits of scale and higher density in the operations.

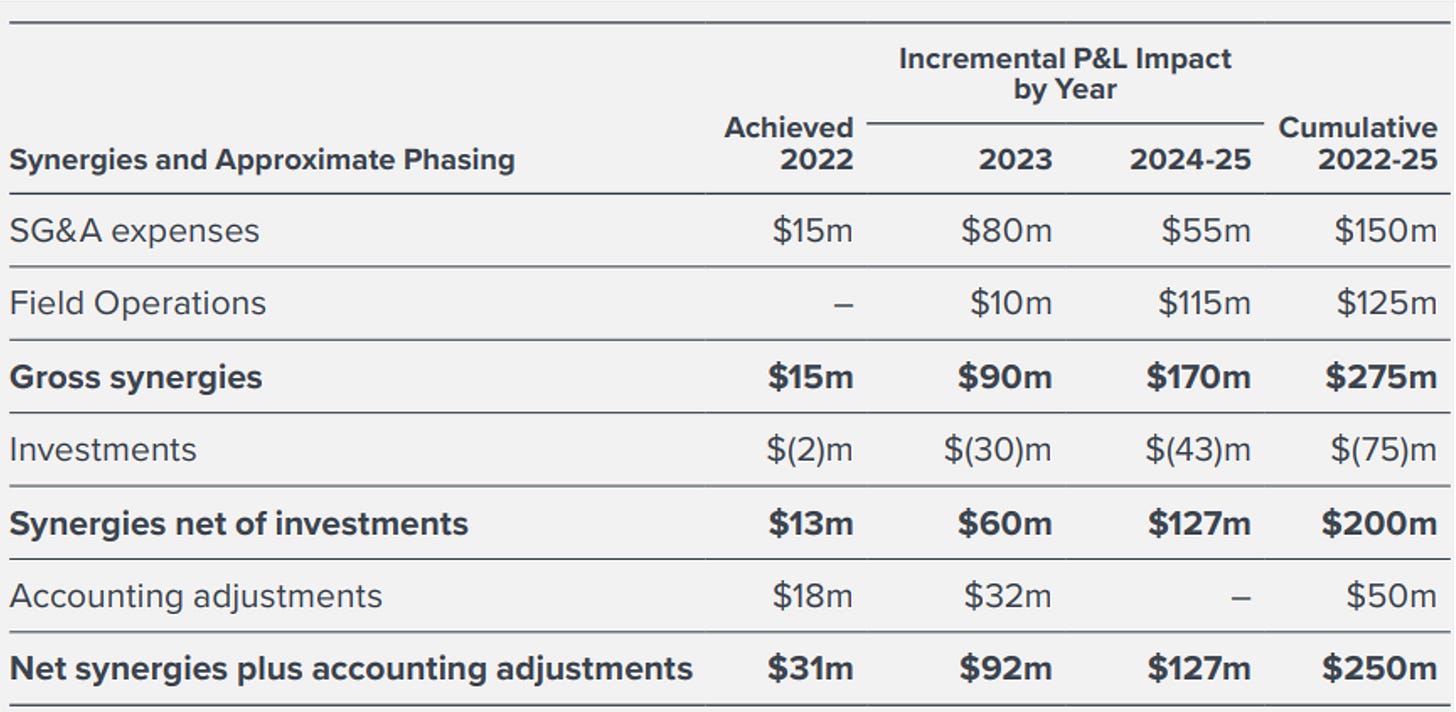

By the end of year three the Company estimates it will have generated pre-tax P&L net cost synergies of at least $200m, with c.$150m of synergies to be delivered from Selling, General and Administrative (SG&A) expenses and c.$125m to be delivered from Field Operations. Total one-time cost to achieve synergies are expected to be c.$200m, increased in line with annualised go-forward synergies.

Source: Annual Reports.

Now, the company expects its expanded scale to be the main driver of growth, with the objective of exceed market growth by 1.5 times from 2025 (Until 2025, the company will need to adjust and optimize the joint structure of both companies).

Source: Annual Reports.

Other very important considerations:

I see their ambition of 100bps annual margin improvement for three years after closing as achievable.

No value has been ascribed to revenue synergies.

Terminix is benefitting from its self-help program ‘The Terminix Way’ and declining legacy termite claims.

2-2.5x Net Debt-to-EBITDA is targeted medium term.

What worries the market.

The price paid for the acquisition. [A considerable price was paid but the great synergies that will be generated between both companies, being the leader of the American market,... has a price].

The increase in debt in this macroeconomic environment. [The company is a great generator of cash, so I am not worried either, although it will take a few years to adjust the debt to normal levels].

Profit warning. Rentokil recently noted temporary lower demand in North America. “It now expects an annual adjusted operating margin for North America of 18.5%-19%, down from its previous guidance of about 19.5%”. [Short-term problems don't worry me either].

Potential for increased termite damage claims as a result of the Terminix acquisition. But Rentokil's CEO is already considering these possible effects in his projections and directions for the company: “Greater exposure to legacy termite claims arising from the Terminix transaction will lower our free cash generation over the next few years as we resolve these customer issues”.

I don't want to make this section too long, but I would like to add the mention that Terminix has historically been poorly managed with four CEOs since its IPO in 2014.

9. Growth through acquisitions.

In in 2022, the company acquired 52 new businesses (excluding Terminix): 46 in Pest Control (with 30 across Growth markets and 16 in Emerging markets), and six in Hygiene & Wellbeing, for an aggregate consideration of £259m (excluding Terminix), as part of our bolt-on M&A programme.

Historically, the company has always been acquiring companies within the sector that is very fragmented.

2016. 41 Deals. £140m acquired revenues.

2017. 39 Deals. £170m acquired revenues.

2018. 56 Deals. £170m acquired revenues.

2019. 41 Deals. £140m acquired revenues.

2020. 23 Deals. £160m acquired revenues.

2021. 52 Deals. £150m acquired revenues.

Rentokil is a serial acquirer and targets 2-5% revenue growth from M&A.

10. Main figures of the bussiness and its evolution.

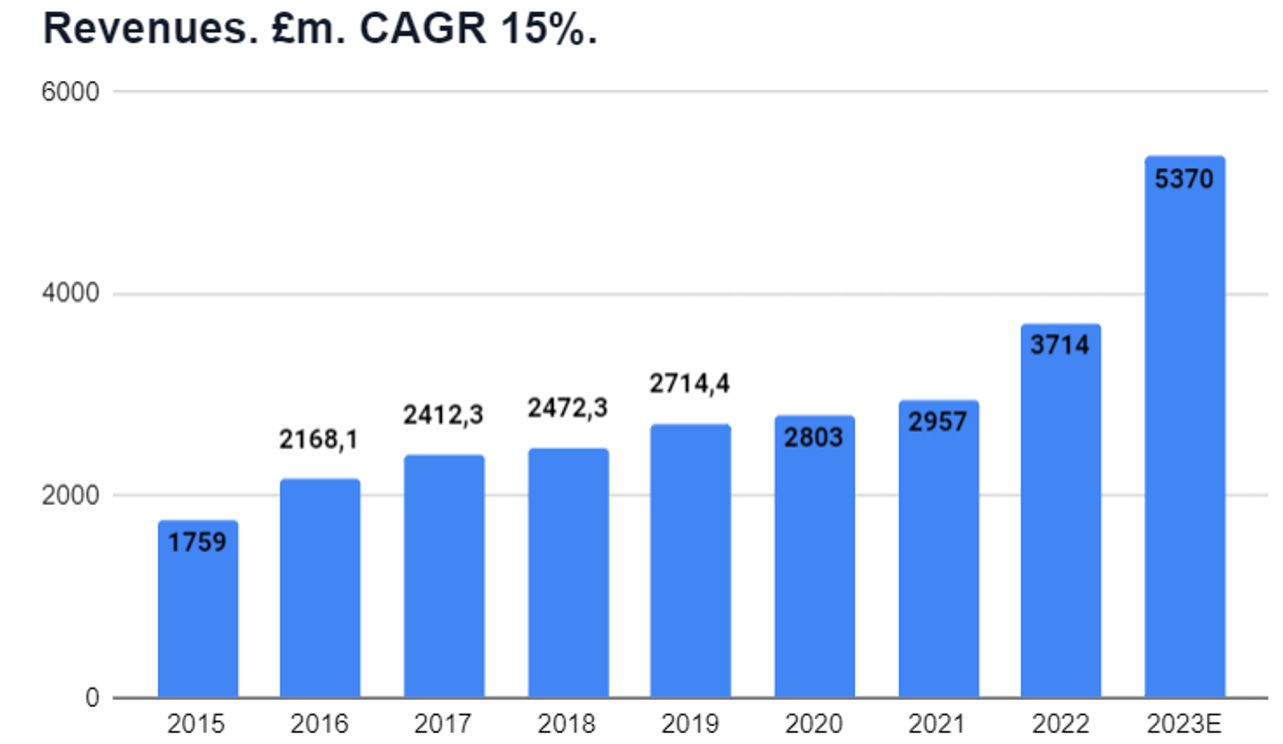

Revenues (£m):

Source: Own elaboration

Gross, operating and net margins (%):

Source: Own elaboration

EBITDA (£m):

Source: Own elaboration

Net Debt (£m):

Source: Own elaboration

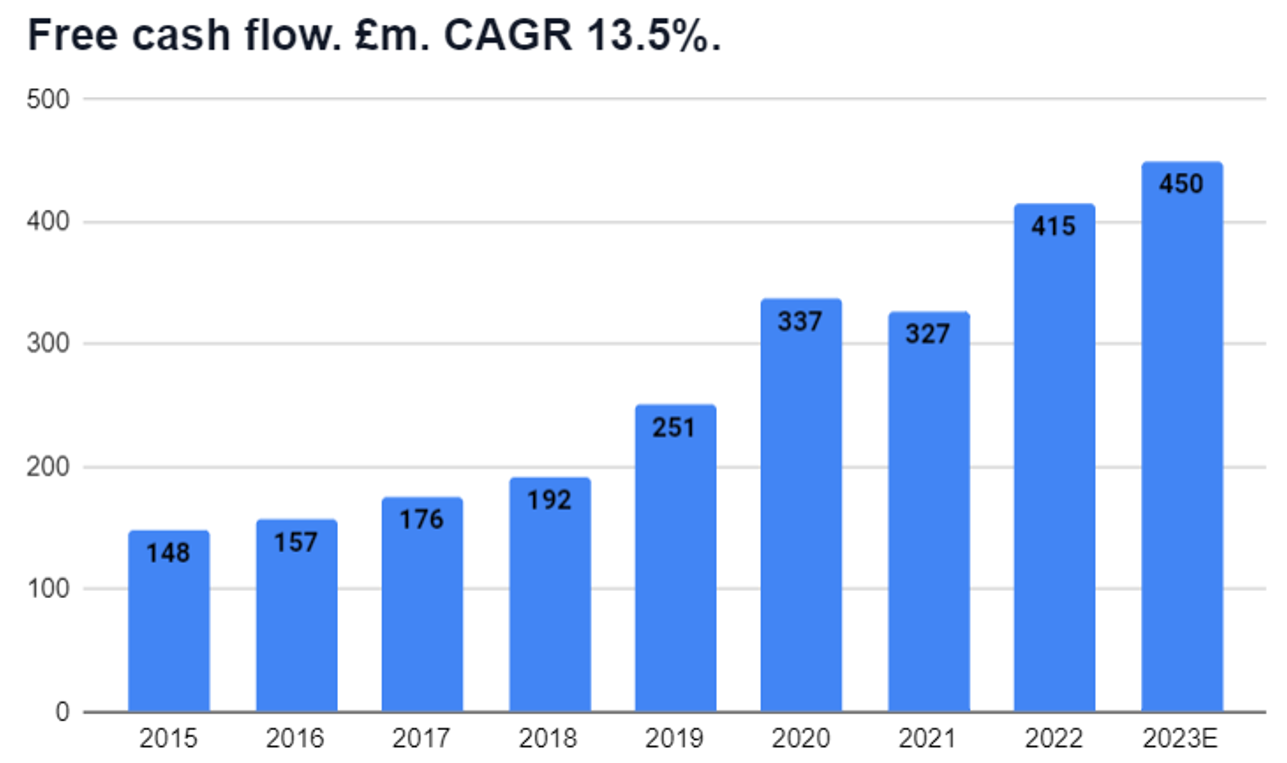

Free Cash Flow (£m):

Source: Own elaboration

Sales, operating profits and operating margins differentiated by Rentokil's three business sectors.

Pest Control / Workwear (France) / Hygiene & Wellbeing

Source: Annual Report

11. Valuation of the company and estimation of future value.

The pest control sector is one of the most defensive sectors that exist. Many defensive consumer companies may suffer if consumers shift to lower-priced products, distancing themselves from their brands during times of crisis. But how long do you want to live with an infestation of rats, mosquitoes, termites, bed bugs and vermins...? Therefore, they are sectors that are very resistant to any economic cycle and are great cash generators. It is one of the oldest, most necessary and most profitable sectors in the world.

It is also a sector where route density and network scale is key. Therefore, the main players can offer the most competitive prices, which is why they increasingly gain more share and are more profitable. This allows them to invest more in improving their products, expanding their defensive moat and gaining market share.

The market recognizes this sector and always demands very high valuation multiples to pay. Personally, I have been following Rentokil's main rival company, which is Rollins, for years, but I have never been able to buy it for the high multiple at which it is listed (even considering its considerable terminal value).

We can see that the usual valuation multiples for market leaders are:

o EV/EBITDA = 20X-30X

o EV/FCF = 30X-40X

Below I include a small comparative valuation table of the main players in the American market at this time:

Source: Own elaboration

From 2013 to today, both Rollins and Ecolab have had average valuation multiples similar to those they currently have. Rollins can be considered a company very similar to Rentokil, and not Ecolab, which is within many different sectors and the comparison is more complicated.

As you can see, Rentokil's valuation is very low compared to its main competitors. The acquisition of Terminix brings together two highly complementary and synergistic portfolios creating the largest pest control operator in the US, the world’s largest pest control market, and a clear global leader in pest control. In addition to having a larger global footprint. (Rentokil 34% US market share; Rollins 22% US Market share).

It must be taken into account that as long as Rentokil does not digest the integration of Terminix, it will have lower profitability since it will have: higher temporary expenses, higher debt, lower ROIC,...but this effect will be reversed when the company manages to integrate Terminix into its structure: taking advantage of cost synergies, gaining market share, achieving more scale and network density, generating a lot of FCF, lowering their debt and interest payments to a more normal level. And even with all this, Rentokil is greatly undervalued compared to its peers (EV/EBITDA, EV/FCF, ROE-P/B).

The ROIC will be temporarily low, due to the acquisition of Terminix:

It will involve additional temporary costs until the end of the integration.

Limitation of FCF generation capacity.

The debt has increased considerably and the costs associated with it as well.

Renkotil is on track for ROIC to exceed WACC by FY 25.

2023 Rentokil current valuation:

Market cap (today) = 10,740 £m

Revenues = 5,370 £m

Ebitda (Adj) = 1,200 £m

Net Debt = 3,200 £m

Free cash flow = 450 £m

Market cap / FCF = 23.87

EV/EBITDA = 11.62

NET DEBT/EBITDA = 2.67

Where do I see growth in the next few years?

General market growth = 5-6%

Bolt-on acquisitions = 2-5%

Operational excellence. Their ambition of 100bps annual margin improvement for three years after closing as achievable.

Terminix Integration. Terminix integration adds between 75%-80% to the size of Rentokil Initial’s Pest Control business in revenue, and it is expected to be highly cash and FCF generating, allowing debt to be reduce at more typical levels. Additionally, the synergies between Rentokil and Terminix will reduce costs and capex, which will also boost FCF. [By the end of year three the Company estimates it will have generated pre-tax P&L net cost synergies of at least $200m].

Adjustment of your valuation multiple compared to your peers. [I do not consider that the difference in valuation compared to Rollins is closed, because Rollins is a company with excellent efficiency and quality, but it is part of the difference in valuation].

I have personally carried out an DCF model, a comparison by multiples against its competitors, and an assessment of its terminal value. And I think there is value here. (You know that I don't like to include a detail of a personal flow discounting analysis, since small changes in the perception of your input provide very different results. But I encourage you to do it).

In a conservative way, I estimate that Rentokil in 2028-2029 could be generating FCF of around £1,000-1,100 million. With an EV/FCF multiple of 30x, the company should capitalize around £30,000m [Current market cap = 10,740 £m]. You already know that I don't like to provide the most bullish scenario possible, since there are things that always go wrong along the way, or the competition does it better,...that's why I emphasize that this valuation is conservative.

DISCLAIMER: This analysis is not a buy or sell recommendation, each person should do their own research before making any kind of investment.

(Company information has been obtained from the annual reports and website).