Musti Group (HEL:MUSTI)

Nordic pet care company. Market share 27%. Double-digit growth. Pricing power.

1. Introduction to Musti Group (HEL:MUSTI).

Musti Group is the leading Nordic pet care company that operates an omnichannel business model to cater for the needs of pets and their parents across Finland, Sweden and Norway.

Company was founded in 1988 when the first Musti ja Mirri pet supply store was opened in Finland by the award-winning dog breeder Matti Varpula. Musti Group entered the Swedish market in 2012. Musti has established a strong platform from which it has driven market expansion on a mission to become the leading pan-Nordic group.

In early 2015, the company expanded its presence in Sweden after acquiring the franchiser of pet specialty chains “Arken Zoo” and “Djurmagazinet”. The add-on also included “Trimmis” grooming salons and the veterinary chain “Vettris”.

In late 2016, Musti Group opened its first stores in Norway.

In 2017, Musti acquired digital competences through the acquisitions of VetZoo and Animal strengthening in-house developer team.

Musti Group was listed in Q1-2020 on OMX Mid Cap Helsinki. The IPO netted a total of EUR 182 million.

In 2023, Musti acquired the pet food factory Premium Pet Food Suomi Oy. The acquisition is a factory producing frozen and dry pet food.

The successful and well-developed concept is based on a wide and curated assortment of pet food, accessories and services in combination with a strong culture of dedicated, knowledgeable and service minded employees. Today, Musti serves more than one and a half million loyal customers enrolled in its loyalty club.

2. Business model and strategy.

Bussines model.

Its omnichannel business model combines the convenience of in-store and online shopping. The expert advice offered by its store staff is at the core of its business model. They differentiate themselves from the competition due to the breadth and quality of their products offered and have a clear strategy of betting on their own and exclusive brands. As part of their customer proposition, they implement more and more new services.

The company has a focused omnichannel operating model with a network of more than 340 physical stores across Finland, Sweden and Norway and over 20% of the net sales generated through online channel.

Musti Group's one-stop shop strategy is tailor-made for pet owners, as the company offers a wide range of premium products, all available in one place.

Musti Group’s concept has a strong customer focus and is built around trust and the expert advice offered by Musti Group’s store personnel. The Musti Group Loyalty Club is designed to serve as a platform to interact with customers and provide them with better customer service. Through the Loyalty Club, Musti Group can leverage data to truly understand its customers' behavior and provide them with targeted and relevant communication. Also, through the loyalty club, members receive targeted communications and special offers, as well as gaining access to their dedicated online account.

Another characteristic is that they focus on hiring truly passionate staff. The highly engaged, motivated and well-trained Musti staff are a key element of Musti Group’s culture and are fundamental to the success of the company’s business model as well as an important competitive advantage.

Musti Group’s management team has an impressive depth of knowledge with strong retail experience.

Musti Group Strategy.

Its main strategy is to continue developing its value proposition and better serve its customers in the Nordic markets, focusing on pet owners.

Winning new customers

Musti Group is well positioned to continue its track record of winning new customers from the large and growing Nordic pool of 5.7 million pets. Succeeding in new customer acquisition, especially acquisition of puppies and kittens, is a key driver of continued market share gain across its Nordic markets.

Its share has been augmented by two initiatives, new puppy and kitten clubs launched in financial year 2020 followed by an upgraded breeder club launched in financial year 2022. These investments into early stages of the pet parenting journey are paying off.

The number of loyal customers, Friends of Musti, increased by 12% to 1,454 thousand during the financial year 2022 continuing the steady growth of earlier years. Its pet loyalty club is the largest in the Nordics.

Grow share of wallet within existing loyal customers.

Growing the share of wallet within its base of 1.5 million loyal customers is a clear opportunity for Musti Group. To deepen the engagement of its customers, Musti is developing an ecosystem approach for Nordic pet parents with the aim to further increase share of wallet and loyalty, with an ‘All you need is Musti’ mentality across the pet lifecycle.

Rolling 12 months average spend per loyal customer was EUR 181.5 in financial year 2022 (EUR 188.3 on 30 September 2021) stabilizing from the pandemic levels and affected by the unfavorable exchange rate fluctuations.

Expand store network and number of service points.

Over the financial years 2021 and 2022, Musti Group has had elevated focus on increasing the coverage of its directly operated network. This investment comes with longer term benefits, as a significant share of its network is currently at ramp-us stage. It aims to continue investing in their network at a more stabilized pace going forward, while continuing to see ample room for expansion especially in the Norwegian market to support further market share gains by entering new local communities.

The number of directly operated stores increased by net 39 stores during financial year 2022. This included new greenfield stores adding convenience to its existing network and acquisitions of 17 stores, mostly formerly operating under franchising agreements in Sweden.

Focus on driving gross margins through increased O&E share and leveraging scale.

A core element of Musti Group’s strategy is growing the share of sales of own and exclusive products sold only in Musti Group’s channels. This comes with three main benefits:

the uniqueness of your offering

loyalty especially in food and other consumable categories

higher gross margin profile.

Musti Group has strong historical track record in driving gross margin improvement. Own and exclusive brands are a cornerstone of their high gross margins as these brands typically carry 10-15 percentage points higher margins compared to global brands.

In addition, they are focused on leveraging scale in procurement supported by pricing and category management. In financial year 2022, gross margin increased to 46.4% mainly driven by increased share of own and exclusive brands, efficient campaigning, and favorable product mix developments.

Musti Group continues initiatives to further strengthen both own and exclusive brands and gross margins. Key initiatives in the financial year 2022 included ramping up dry food production in its pet food factory in Lieto (Finland) and launching Smaak line of own pet food and treats. Share of sales of own and exclusive brands increased to 52.7% (51.0%) during the last year.

Leverage broadly invested platform to drive operating leverage and scale benefits.

Significant investments to Musti Group’s IT, digital platforms and warehouses are expected to drive increased operating leverage and scale benefits to further increase Musti Group’s profitability as topline growth is expected to continue while fixed costs may be spread across larger net sales.

Strategies according to geographic division.

The reporting segment structure is based on a geographical division, on the basis of which Finland, Sweden and Norway have been designated as their own operating segments. Each country has their well-defined country plans to support Musti Group’s growth.

In Finland Musti Group will continue to focus on serving existing customers better in order to increase share of wallet and winning new customers.

In Sweden, the most important country level strategic plan is further expansion and convergence in efficiency and own and exclusive products’ penetration towards Finnish levels.

In Norway, the focus is on continuing the expansion of store network and store ramp-up, as well as margin improvement.

3. Industry analysis and trends.

Musti Group operates in the Nordic pet care market, broadly defined as the sale of pet food, treats, products, services and veterinary care across Finland, Sweden and Norway. The market was estimated to be worth approximately EUR 3.4 billion (in 2021), with Sweden as the largest market, accounting for approximately EUR 1.4 billion, Finland approximately EUR 1.0 billion and Norway approximately EUR 1.0 billion.

Pet Parenting refers to the tendency of people to treat their pets like family members. As a result of this trend, people are spending more on higher quality and more premium food, as well as a more diverse range of products and services. This underlying trend that drives the long-term structural growth of the pet care market remains robust, shifting spend towards higher quality nutrition, a more diverse range of accessories and wider adoption of services.

The pet care market was positively affected by the Covid pandemic over 2020 and 2021, mainly through increased adoption of puppies and kittens and to some extent higher spending on discretionary categories, such as accessories. Puppy adoption rates began normalizing from these peak levels over 2022, while still above long-term averages. The pandemic period resulted in a step-up of Nordic pet ownership rates which increases the addressable market size for future years as the pandemic gains are expected to have a long tail effect.

We are used to seeing how many sectors have suffered a drop in sales after COVID, because they had temporary sales caused by the epidemic (as Eurofins Scientific..). But in this sector, new family members mean recurring sales.

The pet care market is resilient, underpinned by non-discretionary purchasing behavior. Non-discretionary categories such as food, cat litter and veterinary services make up approximately 75% of total market spend and are characterized by repeat purchasing behavior that is consistent through the cycle. Consumers display willingness to sustain spending on non-discretionary pet care purchases even while expenditure on alternative categories has been affected.

Trends in the Nordic pet care market:

Pet parenting

Pet parenting is a major development in pet care that continues to have a profound impact on the global pet care market. People are increasingly treating their dogs and cats like members of their family, spending more on higher quality and more premium food, as well as on a more diverse range of products and services. Musti Group estimates that Pet Parents occupy close to one third of the total pet owning population but account for one-half of the total market spend.

Global consumer megatrends

There are several global consumer megatrends that are highly visible across the pet care market. These include increasing environmental consciousness, desire for convenience in shopping, increasing focus on health and wellness, supply chain transparency and increased demand for services.

Pet population growth and increased number of puppies

The number of pets in Musti Group’s operating markets has been seen to grow throughout the year as a result of an increased number of puppies. This development is driven by the ongoing strong pet parenting trend accelerated by the COVID-19 period and the increase in remote work. These trends form a solid foundation for market growth also going forward. The number of households and the Nordic pet population are expected to continue growing in the coming years.

Channel shift

The increasing prevalence of pet parents across the Nordic countries has led to a channel shift towards pet specialists. Recently there has been a strong shift towards online boosted by the effects of the COVID-19 pandemic on customer behavior.

Resilience of the Nordic pet care market

Consumers display a willingness to sustain spend on pet care through economic downturns, preferring to cut expenditure on alternative spend categories. In the Nordic countries this phenomenon has been clearly evidenced during the COVID-19 pandemic in 2020 as well as previously throughout the 2007–2009 economic downturn.

The global pet services market size is expected to expand at a compound annual growth rate (CAGR) of 9% from 2023 to 2030.

But the nordic pet parenting trend motivates a revenue CAGR of 14.5% between 2021-2025.

This rapid growth is attributable to the megatrend of demographic and social change such as:

the rise of millennials

ageing population

growing middle class

more single people

global changes in attitudes

4. The company in numbers.

4.1 Sales by segment, channel and growth.

Musti Group operates 342 stores with approximately 31% market share in Finland, 29% in Sweden, and 13% in Norway. The Company sells premium pet foods, accessories, and services, of which 78% are sold through physical channels and 22% through E-commerce.

Continued steady online growth accelerated most strongly in post-Covid quarters.

Musti Group’s revenue split consists of 77% pet food and 23% accessories.

Sales growth continues, but it is important to take into account what percentage of sales are recurring and what percentage are discretionary. The resilient food category is generating accelerated double-digit growth.

Discretionary and consumable categories faced high year on year comparison figures.

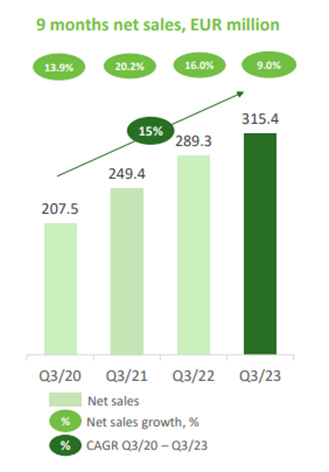

Sales CAGR 15%.

4.2 Market share, margin gross and own and exclusive brands.

Musti Group is the Nordic's largest pet specialist with a market share of 27% (ten times larger than its nearest competitor).

Musti Group offers a wide, curated assortment of pet products in both food and non-food categories and has a broad range of own and exclusive as well as third party brands. 52.7% of sales from own and exclusive brands and 47.3% from third-party brands.

The market share and its scale, its own products, and its high net margins strengthen its pricing power. Own and exclusive brand products are 10-15 percentage points more profitable.

The expansion of own and exclusive brand products combined with the growth of stores will cause gross margin to grow.

Gross margin is being negatively impacted mainly by unfavorable currency exchange rate and sales mix development. (currency weakness in Sweden and Norway).

Musti Group is estimated to generate 59.9% of its topline through sales of their own and exclusive brands in 24/25E.

4.3 Latest acquisitions.

In April 2023, the company announced that it had acquired full ownership of Premium Pet Food Suomi Oy in Lieto, Finland, and the integration work has been progressing very well. The acquisition is a dry and frozen pet food factory.

With this acquisition, the company will have its own factory with products produced sustainably and in its country.

The manufacturing facilities are optimized for raw material supply, as most ingredients are sourced from local producers. Furthermore, the acquisition provides them with the ability to respond to the growing demand for locally and sustainably produced products and the opportunity to increase their profitability by internalizing the production of our own brands. It perfectly supports your strategy. (All energy used in the manufacturing process is fully renewable and factory is equipped with solar panels).

Other acquisitions.

4.4 Main figures of the business and its evolution.

$EUR in million.

Debt to EBITDA ratio = 2.1

ROIC = 8-9%

%Margin ebitda = 16.80%

Dividend = 1.34%*

(*) The company always make it clear that any potential dividend will take into account acquisitions, the company's financial condition, cash flow and future growth opportunities.

4.5 30 Year track record.

4.6 Major holders.

Major registered shareholders.

I would like to see more insiders who own shares within the board and employees. Insiders currently own just over 4% of the shares.

5. Valuation.

Once the company has been reviewed for a valuation, I have considered the following conclusions on which I believe can support its growth:

Nordic pet breeding trend expected to generate 14-15% revenue CAGR between 2021-2025. Pet owners are defined as a segment of pet owners who treat their pets as part of the family. Nordic pet breeding is growing six times faster than the total pet market and spends, on average, twice as much compared to typical pet owners. All of this is expected to benefit Musti Group's revenue and profits as the company has the largest market share of premium pet products in the Nordic countries.

Store network expansion and store growth enable revenue growth. Grupo Musti currently has a commercial network of more than 342 stores. Each store matures, on average, within three years, leading to rapid growth. The stores have a 2-year recovery profile. In 2022, Musti Group increased its number of directly operated stores by 39 and the company continues to open new stores to gain customers.

Margin expansion driven by store and new product growth. In addition to the maturation of the recently opened stores.

Pricing power. The market share and its scale, its own products, and its high net margins strengthen its pricing power. Own and exclusive brand products are 10-15 percentage points more profitable. The expansion of own and exclusive brand products combined with the growth of stores will cause gross margin to grow. Musti Group has 1.5 million loyal customers who buy unique products only sold by the company (through its own channels).

In the last quarter, inflation was mitigated by net price increases of 8% and sales did not suffer.

The Company is acquiring customers representing 60% of all newly registered puppies, demonstrating that the Company has an effective customer acquisition strategy.

Fragmented market creates opportunities for Musti Group. The presence of many small players generates an exceptional scene for main players in the market to increase market share through acquisitions. As the main player in the market, Musti Group is expected to consolidate the market. In 2022 Musti Group acquired 19 pet stores through acquisitions.

The Company pursues a one-stop shop strategy, increasing value for customers with educated store personnel that can recommend suitable products based on specific pet needs. The concept is evidenced by the Company's 90% annual retention rate, the highest among the Company’s peers.

2023 Valuation:

Market cap (today) = 620 M eur

Revenues = 418 M eur

Ebitda (Adj) = 70 M eur

Net Debt = 147 M eur

Free cash flow = 52.4 M eur

Enterprise value/ FCF = 14.64

EV/EBITDA = 10.95

NET DEBT/EBITDA = 2.10

%margin ebitda = 16.80%

I am not very in favor of including discounted cash flows because anyone could play with the parameters and draw very different conclusions. Or simply base the analysis on valuation multiples by looking at competing companies such as (Pet at Home Group, Pet Valu Holding, Petco Health & Wellness,…) that are located in different regions, with different models, different market shares, different competitive advantages... There are companies where I do like to do it but companies where I think it doesn't make much sense.

2027 Valuation based on analysis:

Market cap (today) = 620 M eur

Revenues = 700 M eur

Ebitda (Adj) = 140 M eur

Net Debt = 294 M eur

Free cash flow = 98 M eur

Enterprise value/ FCF = 7.82

EV/EBITDA = 5.48

NET DEBT/EBITDA = 2.10

%margin ebitda = 20%

Share of Own & Exclusive Sales -> 60-63%

Today Musti Group's market price is 620 mill EUR, I have estimated that in 2027 the market price could be 1,300-1,400 mill EUR (I think that is a conservative estimate). I don't like to think that everything will work out perfectly.

I consider that Musti Group could be a good investment idea, because it has a strong base to continue growing, certain competitive advantages, dominates its market share, pricing power, and is not excessively valued. Perhaps the market could go down its valuation even more and make it more attractive, but today it is already a good option. It must be taken into account that it is a microcap and the volatility can be considerable. Which can work in our favor, giving us moments where we can buy or increase the margin of safety.

This article is not a stock buy recommendation. All investors are advised to conduct their own independent research into individual stocks before making a purchase decision.