Investors Title Company (NASDAQ:ITIC).

Small family business with a long-term vision culture. Outperforms the S&P500 (20 Years). Solid balance and great flexibility to adapt to any environment.

1. Introduction to Investors Title Company.

Investors Title Company was founded in 1972 by J. Allen Fine. Mr. Fine successfully raised the funds necessary to capitalize the company and take it public.

Investors Title Company, a holding company incorporated in North Carolina in 1973, is the parent company of two wholly owned title insurance underwriting subsidiaries: Investors Title Insurance Company (ITIC) and National Investors Title Insurance Company (NITIC). The Company’s primary business activity is the issuance of residential and commercial title insurance.

Title insurance dates back to the late 1800s, yet the volume of the title insurance written remained low through the early 1970s. That changed dramatically when lenders began to sell their mortgages on the secondary market, a transformative event that Mr. Fine anticipated. As a result of his foresight, Investors Title was established, has successfully expanded into select markets, and consistently maintains above-average profitability despite economic downturns.

The Company became operational in 1976 when it acquired ITIC as a wholly owned subsidiary under a plan of exchange of shares of common stock. ITIC has been operating since 1972. In 1983, the Company acquired NITIC, formerly Northeast Investors Title Insurance Company, under a plan of exchange of shares of common stock. NITIC has been operating since 1973.

Schedule of notable company events:

1972. Investors Title Insurance Company is incorporated in North Carolina and established with a capital investment by J. Allen Fine, followed by an initial public offering of stock.

1973. Investors Title Company is established as holding company for Investors Title Insurance Company and other subsidiaries.

1985. Investors Title grows to become the leading title insurer in North Carolina.

1985. The Canada Goose is adopted as the Investors Title corporate icon. The "V" flying formation of a flock of geese embodies the instinctive trait of innovation that enables collaborative effort to optimize team aerodynamics, supports the ability to thrive in a diverse range of habitats, and provides unwavering stability. It is Investors Title's instinctively client-centric approach to developing innovative business processes and solutions that sets it apart.

Photo by Karen Hammega on Unsplash 1986. Stock begins trading on NASDAQ National Market.

1988. Investors Title Exchange Corporation is established to provide 1031 exchange services and act as a qualified intermediary in tax-deferred exchanges of real property. Investors Title Exchange Corporation was one of the first organizations of its kind specifically structured to handle these types of transactions.

1994. Investors Title Accommodation Corporation is established to provide an exchange accommodation title holder vehicle for reverse exchanges.

1999. Investors Title Management Services, Inc,. is established to provide management services to affiliate owned title and real estate providers.

2001. Launch of EFLITE - an innovative, web-based application for preparing title reports, opinions, and supplemental documents.

2004. Investors Trust Company is established in North Carolina to provide investment, trust, and fiduciary services to individuals and entities.

2011. Launch of iTracs - a proprietary escrow reconciliation serviceoffered by Investors Title Management Services that features automated 3-way reconciliation, daily reporting of account activity, customized alerts of irregularities or critical errors, monthly third-party review, and audit-ready and state-bar compliant reporting.

2014. A.M. Best first assigns a financial strength rating of A (Excellent) to Investors Title Insurance Company.

2017. Investors Title is recognized as second in the list of best-run public companies in North Carolina by the Triangle Business Journal.

2019. Investors Title founder and CEO, J. Allen Fine, named as one of the recipients of the Triangle Business Journal's 2019 CEO of the Year award.

2020. ClientCONNECT EFLITE is launched to North Carolina customers and enhances the time-saving solutions of the original application.

2022. Investors Title celebrates 50 years of operations.

Main geographic locations of the company:

ITIC is licensed to write title insurance in 44 states and the District of Columbia. ITIC currently writes title insurance as a primary insurer in 22 states and the District of Columbia, primarily located in the eastern half of the United States, and as a reinsurer for NITIC and third-party title insurance companies.

NITIC is licensed to write title insurance in 20 states and the District of Columbia. In November 2014, NITIC redomesticated to Texas. NITIC currently writes title insurance as a primary insurer in Texas, and as a reinsurer for ITIC.

Premiums from title insurance written on properties located in North Carolina, Texas, South Carolina and Georgia represent the largest source of revenue for the title insurance segment. In North Carolina, a majority of the Company’s title insurance commitments and policies are issued directly. In Texas, South Carolina, Georgia and other states, title policies are primarily issued through issuing agents.

In 2022, North Carolina, Texas, South Carolina and Georgia represented 35.6%, 29.0%, 9.4% and 9.2% of total premiums written by the Company, respectively.

2. Bussiness model and its main areas.

Investors Title is headquartered and has most of its branches in North Carolina. The company subscribes directly and issues title insurance policies and retains the full premium since no commissions are paid to agents. Operations in homes and branches have ranged between 20% and 30% of premiums.

The company operates with many independent title agencies which are responsible for underwriting and issuance of policies. These agencies retain the majority of the premium and remit the remaining amount to Investors Title. Outside In North Carolina, almost all premiums come from agencies.

Investors Title underwrites premiums in exchange for protection against risks. Their goal is to make underwriting profits and earn investment returns for policyholders. This “floating” capital is funds that will be necessary to pay possible make claims in the future. This means that the floating capital can generate investment income for many years.

Therefore, the Company’s primary business activity, and its only reportable operating segment, is the issuance of residential and commercial title insurance through ITIC and NITIC.

The company's business areas are: Title Insurance, Reinsurance, other services.

Title Insurance area. (If you have never analyzed a company in this sector, below I explain the title insurance area showing answers to classic questions that we can ask ourselves).

What is title insurance and what does it protect?

The Company underwrites title insurance for owners and mortgages as a primary insurer. ITIC and NITIC offer primary title insurance coverage to owners and mortgagees of real estate and assume reinsurance of title insurance risks from other title insurance companies. The commitments and policies are predominantly issued using standard forms approved by the American Land Title Association (“ALTA”).

Title insurance protects against losses resulting from title defects affecting real property. Upon a real estate closing, the seller of real property executes a deed to the new owner, and typically, the property is encumbered with a new mortgage. When real property is conveyed from one party to another, occasionally there is an undisclosed or undiscovered defect in the title or a mistake or omission in a prior deed or mortgage that may give a third party a legal claim against such property or result in the invalidity or unenforceability of the insured mortgage. If a claim is made against the title to real property, title insurance provides indemnification against covered defects.

Numerous types of defects could jeopardize the property owner’s or mortgagee’s interest in the property for which a title policy may provide coverage. Such risks include title being vested in an individual or entity other than the insured, lack of a right of access to the property, invalidity or unenforceability of the insured mortgage, or other liens or encumbrances that make the property unmarketable. The policy may provide coverage for defects arising from prior unsatisfied mortgages, judgments, tax liens or confirmed assessments, or encumbrances against the property arising through easements, restrictions or other existing covenants. Title insurance may also protect against deeds or mortgages that were forged or improperly acknowledged or delivered, that were executed by spouses without the other spouse’s signature or that were conveyed by minors or other persons who lack legal capacity.

The Company issues title insurance policies based on a search of public records. The title search documents the current status of title to the property. There are two basic types of title insurance policies – one for the mortgage lender and one for the real property owner. A lender often requires property owners to purchase title insurance to protect the priority of its mortgage loan, but the lender’s title insurance policy does not protect the property owner. The property owner has to purchase a separate owner’s title insurance policy to protect its investment.

What options are there to resolve a claim?

If a claim is made against an insured property’s title, the insurer can choose to pay the cost of eliminating the covered title defects or to defend the insured party against the covered title defects affecting the property.

In the alternative, the insurer may opt to pay the policy limits to the insured or, if the loss is less than the policy limits, the amount of the insured’s actual loss due to such title defects, at which time the insurer’s duty to defend the claim and all other obligations of the insurer with respect to the claim are satisfied.

How are title insurance underwriting operations operated?

ITIC and NITIC issue title insurance policies directly and through a network of agents. Issuing agents are typically real estate attorneys, independent agents or subsidiaries of community and regional mortgage lending institutions, depending on local customs and regulations and the Company’s marketing strategy in a particular territory. The Company’s title insurance subsidiaries determine the terms and conditions upon which they will insure title to real property according to the Company’s underwriting standards, policies and procedures. Title insurance premiums written reflect a one-time premium payment, with no recurring premiums.

How is the premium for internal/external agents managed?

Generally, premiums for title insurance are recorded and recognized as revenue at the closing of the related transaction, when the earnings process is considered complete. When the policy is issued directly, the premiums collected are retained by the Company. When the policy is issued through a non-wholly owned title insurance agency, the agency retains a majority of the premium as a commission and remits the net amount to the Company. Title insurance commissions earned by the Company’s agents are recognized as expenses concurrently with premium recognition. The percentage of the premium retained by agents varies by region and is sometimes regulated by the states where the property is located.

How long do licenses to issue insurance last?

Each state license authorizing ITIC or NITIC to write title insurance must be renewed annually. These licenses are necessary for the companies to operate as a title insurer in each state in which they write premiums.

What magnitude do complaints usually have?

The claims are relatively rare and are expected to represent a small percentage of revenue. In terms of administration, the company has tended to overbook, as can be seen if the negative figures in the provision for claims from previous years. In the last years the company has a provision for losses to represent a small percentage of revenue (average 2.5-3% of sales 2023). From 2000 to 2010 the company had a provision for losses of around 10%. (It shot up to almost 24% in 2008). I have been able to read that thanks to digitalization the % of complaints has been reduced in the lasy years, but I cannot be sure by what percentage this is due to that. It could be that they were keeping fewer provisions, but the board has demonstrated a significant degree of conservatism over the years.

Reinsurance area.

In the ordinary course of business, ITIC and NITIC reinsure certain risks with other title insurers to limit their risk exposure and to comply with state insurance regulations. They also assume reinsurance for certain risks of other title insurers for which they receive additional income in the form of reinsurance premiums. For each of the last two years, revenues from reinsurance activities accounted for less than 1% of total premium volume.

Other areas.

Additionally, the Company provides:

tax-deferred real property exchange services through its subsidiaries, Investors Title Exchange Corporation (“ITEC”) and Investors Title Accommodation Corporation (“ITAC”).

ITEC acts as a qualified intermediary in taxdeferred exchanges of real property held for productive use in a trade or business or for investment, and its income is derived from fees for handling exchange transactions and interest earned on client deposits held by the Company.

ITAC provides services as an exchange accommodation titleholder for accomplishing “parking transactions”. These transactions include reverse exchanges when taxpayers decide to acquire replacement property before selling the relinquished property, or “build to suit” exchanges, when improvements must be made to the replacement property before the taxpayer acquires the improved replacement property.

investment management and trust services to individuals, trusts and other entities through its subsidiary Investors Trust Company.

management services to title insurance agencies through its subsidiary, Investors Title Management Services (“ITMS”). Investors Trust provides investment management and trust services to individuals, companies, banks and trusts. ITMS offers various consulting and management services to provide clients with the technical expertise to start and successfully operate a title insurance agency.

3. Some important differences between title insurance and conventional insurance.

Differences in relation to operating expenses.

Since title insurance is an evidence-producing/loss-prevention line of insurance, its loss expense is less than and its operating expense is greater than that of other property/casualty lines of business. Insurance expenses are loss-prevention, underwriting-related and loss-related.

Operating expenses are the largest component of a title company's costs. A title company's ability to expand its infrastructure and maximize operating profits in good market conditions, and to contract and control costs in poor market conditions, is critical to its long-term financial success and solvency. This isn't necessarily the case with property/casualty companies, where the control of loss costs is more critical to success and solvency.

Because of title insurers' dependency on the health of the real estate market and favorable interest rates - as well as their being required by law in most states to be monoline writers - title industry revenues and profitability are susceptible to volatility. To dampen this volatility, title insurers have:

Improved their technology and work-flow processes.

Diversified their operating revenue by introducing new title products and expanding nationally and internationally.

Differences in relation to investments.

Property/casualty insurers collect premiums in advance and hold them until they must indemnify claimants for losses. These premiums constitute a large cash flow that companies generally invest in intermediate and long-term, investment-grade assets. The investment income generated is reinvested, and a company's asset base grows at a compounded rate until losses on policies materialize and are paid. Claims for the long-tail casualty business lines might take decades to appear and the accruing premiums can add significantly to a company's assets. As a property/casualty company's ratio of written premiums to surplus (equity) increases, the fraction of total assets that are financed by advanced premiums from policyholders also increases. In other words, writing property/casualty insurance can create financial leverage.

Title companies collect premiums after the largest component of their costs - operating expenses - has been incurred. Title companies' expense ratio typically averages more than 90, while the property/casualty industry's expense ratio is less than 30. The title industry's higher expense ratio results in a significant reduction in available cash flow for companies to invest. Although the remainder of the title premium is available for investment, the relative percentage of premium collected and invested is significantly less than that of the property/casualty industry. As such, the title industry's financial leverage is relatively low.

Title insurers use much of the premiums collected to cover the underwriting costs associated with the issuance of a title insurance policy. In contrast to property/casualty insurers, title insurers expend premium dollars before collection, and therefore do not retain most of the premium dollars before they are expended in the ordinary course of business.

On the other hand, the loss tail for title insurers is much longer than that of most other lines of insurance, and it constitutes a form of leverage where some percentage of premiums is set aside and held for future claims. The loss-tail leverage constitutes only a small percentage of the premiums, however.

4. Main competitors.

The title insurance industry is highly competitive and is a regulated oligopoly. The four largest title insurance companies typically maintain greater than 80% of the market for title insurance in the United States, with smaller regional companies holding the balance of the market. The market shares are as follows (they vary from year to year but this could be an average of recent years):

Fidelity National Financial 34%

First American Corporation 25%

Old Republic National Title Insurance Company 15%

Steward Information Services 10%

Others 16%. (Investors Title Company has a 1% market share).

In the United States, there are over 5,100 title insurance companies.

The number and size of competing companies varies in the respective geographic areas in which the Company conducts business. Key competitive factors in the title insurance industry are:

the financial strength

the size of the insurer

the timeliness and quality of service

the price

the expertise in certain transactions.

Title insurance underwriters also compete for agents based upon service and commission levels.

Some title insurers currently have greater financial resources, larger distribution networks and more extensive computerized databases of property records and related information than the Company.

5. Management team.

J. Allen Fine was the principal organizer of Investors Title Insurance Company and has been Chairman of the Board of the Company, Investors Title Insurance Company, and National Investors Title Insurance Company since their incorporation. Mr. Fine served as President of Investors Title Insurance Company until February 1997, when he was named Chief Executive Officer. Additionally, Mr. Fine serves as Chief Executive Officer of the Company and National Investors Title Insurance Company, and Chairman of the Board of Investors Title Exchange Corporation, Investors Capital Management Company and Investors Trust Company.

Mr. Fine is the father of James A. Fine, Jr., chief financial officer and executive vice president of the company, and W. Morris Fine, president and chief operating officer of the company.

Percentages of participation in the ownership of the company.

J. Allen Fine 10.39%

James A. Fine, Jr 9.44%

W. Morris Fine 4.43%

Image obtained from The Demotech Difference magazine’s Legacy of Longevity series (fall 2022 edition) [click here]

It should be noted that he also has a significant stake in the company, in my opinion one of the best capital allocators that exist, such as Tom Gayner (CEO of Markel Corporation). Percentage of participation in the ownership of the company.

Markel Corp 11.28%

Therefore, we could say that we have 35% of the company's shares in the hands of owners with ownership vision.

6. Industry growth trend and cyclicality nature. Current state of the real estate market.

About the industry growth trend.

The title industry continues to play a critical role in the U.S. economy by insuring the proper transfer of real estate from buyer to seller and by facilitating the growth of the secondary mortgage market. This enables Americans to have one of the highest home ownership rates in the world.

The industry has grown steadily in the last years. Factors like a robust housing market, low interest rates and increased refinancing activity stoke this growth, despite challenges like intensified competition and skilled worker shortage.

Between 2007 and 2017, the title insurance industry’s direct premiums written increased by about 50%.

The market size of the Title Insurance industry in the US has grown 9.8% per year on average between 2017 and 2022.

The global Title Insurance market is expected to expand at a CAGR of 8-9% during the forecast period 2023-2027.

About the cyclitality and seasonal.

Real estate activity, home sales and mortgage lending are cyclical in nature. Title insurance premiums are closely related to the level of real estate activity and the average price of real estate sales. The availability of funds to finance purchases directly affects real estate sales. Other factors include mortgage interest rates, consumer confidence, economic conditions, supply, demand and family income levels. The Company’s premiums in future periods are likely to fluctuate due to these and other factors which are beyond management’s control.

Historically, the title insurance business tends to be seasonal as well as cyclical. Because home sales are typically strongest in periods of favorable weather, the first calendar quarter tends to have the lowest activity levels, while the spring and summer quarters tend to be more active. Refinance activity is generally less seasonal, but is subject to interest rate fluctuations.

About the current state of the real estate market and factors that affect ITIC's business.

The demand for title insurance products is largely dependent on the demand for real estate transactions, which are, in turn, critically dependent on:

the financial factors (interest rates).

as well as on a healthy labor market characterized by low or decreasing unemployment rates and generally increasing wages.

a stable inflation environment helps to ensure market stability and consumer purchasing power.

I do not intend to include my vision of the American real estate market here, since everything that depends on macroeconomics will be very risky assumptions and I do not have that knowledge. But I can include several pieces of information to reflect on the current state:

The national average 30-year mortgage rate rose for the sixth week in a row to 7.63% in the third week of October, according to Freddie Mac. Consider whether mortgage rates are more likely to rise or fall. I see it as more likely that they will go down in the medium term favoring ITIC business.

With many homeowners “locked in” at low interest rates and unwilling to sell, demand continues to exceed for-sale inventory.

Housing market activity remains weak thanks to rising mortgage rates, elevated home prices and constrained housing inventory—a trifecta of headwinds perpetuating the housing affordability crisis. Home affordability sank to its lowest level in more than three decades, according to the latest Real House Price Index (RHPI) released by First American Financial Corporation.

In August, 82% of consumers reported putting home-buying plans on hold, according to the latest Fannie Mae Home Purchase Sentiment Index (HPSI).

It’s clear that the home buyers are more affected by the speed of mortage rate changes rather than the spot rate itself.

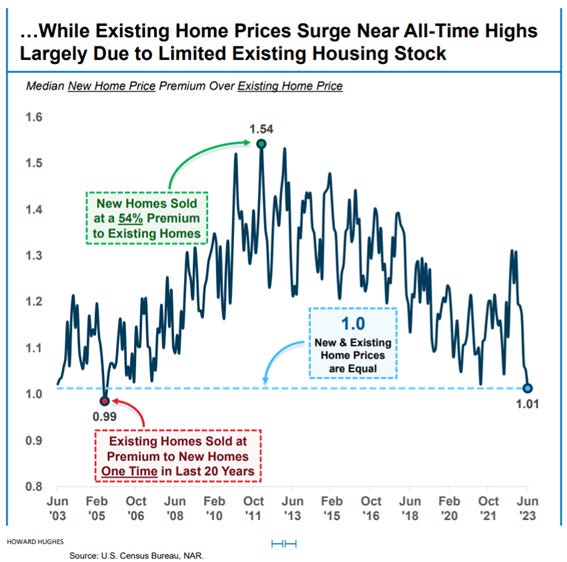

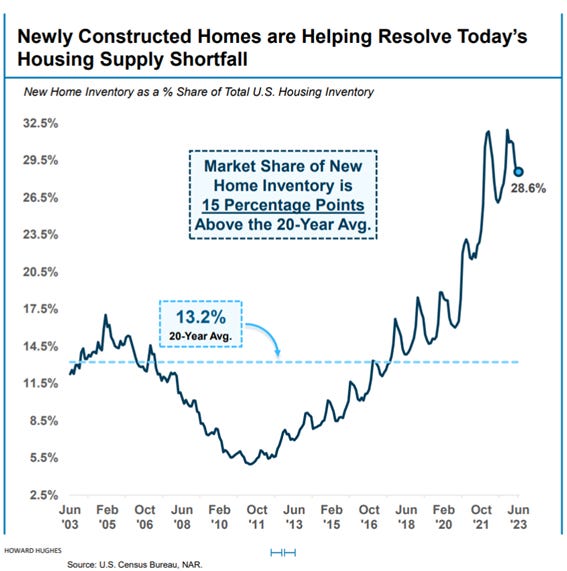

With the following images I intend to reflect several important aspects of the current state. I will not comment on them so as not to extend the thesis further, and I also think that the graphs are quite clear. (The following images are obtained from a Howard Hughes Holding presentation which in turn obtained the information from “U.S. Census Bureau, NAR, Freddie Mac”).

7. Performance in the markets since its IPO.

The evolution of the share price in the markets has been as follows.

From 1986 to 2023 (Stock begins trading on NASDAQ National Market). The first years of the company were not excellent as it had to consolidate and adjust its business model.

ITIC +1,478% (withouth dividend) vs S&P500 +1,642% (Image from Yahoo Finance).

From 2000 to 2023. In the last 23 years the company has improved the profitability of the S&P500 index.

ITIC +787% (without dividend) vs S&P500 +212% (Image from Yahoo Finance).

The company has had two falls of more than 20% (2007 & 2022), and three falls of more than 15% (1994, 1999 and 2009). (Image obtained from Macrotrends.net).

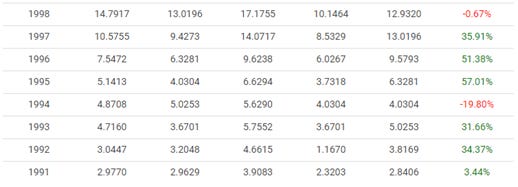

We can see the returns in the price of its shares without considering dividends.

From 2001 to 2008. The price per share went from 9.78 USD/Share to 24.46 USD/Share (>12% annualized return without dividend).

From 2009 to 2016. The price per share went from 24.46 USD/Share to 109.30 USD/Share. (>20% annualized return without dividend).

From 2017 to 2023. The price per share went from 109.30 USD/Share to 146.84 USD/Share. (>4.4% annualized return without dividend). But we must take into account the enormous extraordinary dividends in recent years, of more than 45 usd/share. During 2020 and 2021, Investors Title earned cumulative net income of $106 million and distributed 69 million dollars to shareholders, through special dividends.

(Image obtained from Macrotrends.net).

8. Main figures of the bussiness and its evolution.

I include below the main results of the company over the last few years to see its evolution, cyclicality, variation in margins, value creation....

Revenues (Usd in million):

Operating profit, net profit, Ebitda, dividends and others (Usd in million):

It can be recognized that a strong part of the home sales cycle has just happened in the years 2019, 2020 and 2021, but the market has stopped. And that can be seen in the company's results this year or 2022. This affection becomes clearer to me if we look at the sales market for existing homes.

The company pays a regular quarterly dividend equivalent to a yield of 1.2%. Starting in 2017, the company gave several special cash dividends to the shareholders.

Investments (Usd in million):

Currently, the short-term investments represent 50% of investments, the fixed maturity securities represent 30%, the equity securities investments represent 15% and other investments represents a 5% .

Book value and net debt (Usd in million):

We can observe the sustained growth of the book value and always the negative net debt.

Free cash flow (Usd in million):

9. Bussiness valuation and a comment on the latest results.

As in “section 8”, I have only included results until the end of 2022, I include here the comparison with the most updated 2023 results (last week). We can see how, given a 33% drop in the “Net premiums written", they can easily be freed from the costs of that network of independent title agencies and other costs. It must be taken into account that this network will have to be hired again in the future so it has to be a win-win and not about firing the entire network suddenly from one day to the next. Here you may have some non-productive expenses for a while but the staff in the sector is scarce, so you have to take care of it. But in a survival situation it could be drastically reduced.

The drop in net premiums written has been occurring since 2021, which was the year with the most activity in the real estate market (Sales for the year 2023 estimated with respect to Q3 data). And consequently the reduction of expenses in independent agents. (Units: million USD)

Unrealized gains and losses on capital investments are highly variable in the short term. But, if interest rates rise and the real estate market slows down, they will try to compensate with profits from investments in short-duration fixed income that allows them to adapt to recent rates. As the months go by, they will be able to update investments at higher rates.

I have included this small comparison of the evolution of the last two years to try to indicate how we are in the lower part of the cycle, although we do not know at what exact point. So let's keep this in mind when making the following assessment.

One of the most difficult parts of cyclical stocks can be detecting the current moment within the cycle. It can be recognized that a strong part of the home sales cycle has just happened in the years 2019, 2020 and 2021, but the market has stopped. And that can be seen in the company's results this year. This affection becomes clearer to me if we look at the sales market for existing homes.

2023 Valuation:

With the company’s stock trading at $146.84, Investors Title has a market capitalization of $277 million. Currently the shares trade at 1.12x book value. The company has an investment portfolio of $227 million, and negative net debt of $24.00 millions.

Market cap (today) = 277 M USD

Revenues = 230 M USD

Ebitda = 33.15 M USD

Net Debt = -24.00 M USD

Free cash flow = 23.00 M USD

Enterprise value/ FCF = 11.00

Free cash flow yield = 9.10%

EV/EBITDA = 7.67

NET DEBT/EBITDA = -0.73

%margin ebitda = 14.4%

Price to Book value = 1.12x

ROE = 10%

Conclusion about the company.

I think the current valuation is attractive regardless of the economic context. But if we consider the current part of the real estate cycle and its strong contraction, I think it can be even better.Investors Title may be a small company in total market size in the United States, but it has a good share in the states that represent the majority of its business and has a proven history of solid and profitable operations.

Its small size allows it to grow faster than the market in which it operates.

The company has a proven history of strong balance sheets and profitable operations.

The company was able to handle the 2008 crisis in an exceptional way.

The company is well positioned for the future if we look at the areas in which it operates. The largest states in which the company operates experienced significant positive net migration during the pandemic.

The company has aligned management team with skin in the game and with extensive experience.

The company's capacity for flexibility with demonstrated experience in crisis situations in the sector.

By maintaining a good relationship with multiple independent title agencies, in times of economic prosperity they can deploy a large network and capture large profits (personnel costs increase a lot).

And in times of crisis in the real estate sector, they are easily freed from the costs of that network of independent title agencies (personnel costs are greatly reduced).

The objective of the directive is to reduce the cyclical nature as much as possible. If interest rates rise and the real estate market slows down, they will try to compensate with greater profits from investments in short-duration fixed income that allows them to adapt to recent rates.

Business culture with a long-term focus, whose key aspect is survival.

They have been heavily developing digital tools to further minimize possible insurance claims, despite having less financial muscle than the main players in the market.

The company has a solid balance sheet, conservative investments, consistently positive free cash flow.

The claims are relatively rare and they represent a small percentage of revenue.

The company had the ability to generate returns superior to the S&P500 in the last two decades.

Therefore I consider that it could be an interesting option, at current valuations. Taking into account that it is a small cap, the market offers prices with greater discounts than the current one a couple of times a year. After analysis, I believe that this investment can offer you a return of between 8-12% annually in the next 5-7 years, taking into account dividends, a small adjustment of multiples, and the profitability of the business.

“My goal was to keep losses down, and if I could catch a few stocks going up, compound returns would work their magic.” Walter Schloss.

DISCLAIMER: This analysis is not a buy or sell recommendation, each person should do their own research before making any kind of investment.

(Company information has been obtained from the annual reports, and the following web pages have been consulted: TIKR.com, Yahoo Finance, Macrotrends).

Great write-up and interesting business! How did you come up with this idea?

In my latest Friday Roundup, I included a link to your insightful analysis👇

https://open.substack.com/pub/rhinoinsight/p/the-friday-roundup-14c?r=2587ts&utm_medium=ios&utm_campaign=post