Eurofins Scientific (EPA:ERF)

Growth, competitive advantages, quality and value in a single company. An investing idea.

1. Introduction to Eurofins Scientific (EPA:ERF).

Eurofins Scientific was founded in 1987 with 3 employees and 1 laboratory to market a patented analytical method used to verify the origin and purity of several types of food and beverages and identify sophisticated fraud not detectable by other methods.

Today, Eurofins Scientific SE, together with its subsidiaries, provides various analytical testing and laboratory services worldwide. The company offers a portfolio of approximately 130,000 analytical methods to evaluate the safety, identity, composition, authenticity, origin, traceability, and purity of various products.

Eurofins provide services in several sectors as:

Agroscience Services

Agro Testing

Assurance

BioPharma Services

Clinical Diagnostics

Consumer Product Testing

Cosmetics & Personal Care

Environment Testing

Food and Feed Testing

Forensic Services

Genomic Services

In Vitro Diagnostics Solutions

Maritime Services Materials and Engineering R

EACH Services

Sensory and Consumer Research

Sustainability Services

Eurofins Group is a leading provider of testing and analytical services with: an international network of ca. 900 laboratories in 61 countries over 61,000 staff, a portfolio of over 200,000 analytical methods and more than 450 million tests performed each year.

2. Business model

Eurofins' model and key is based on its core focus on rapid turnaround times (TAT): efficient delivery of results to clients through its strong network of 940 laboratories and offer of more than 200,000 test modalities. It is segmented by:

four main businesses: pharma and agrosciences, food testing, environment testing and clinical diagnostics.

several types of test modalities (chemical, clinical, genomic, and biological).

varied methods, from old technologies to the latest innovative developments.

great geographical breadth (50+ countries and global down to local);

and depending on the market, varying regulations and environmental priorities.

The Company benefits from society’s growing need for testing due to demands for better health, cleaner environments, and safer pharmaceuticals, food and other products. These factors comprise an attractive market environment giving Eurofins multiple growth opportunities.

The decentralized structure of companies run by Eurofins promotes closer relationships and more individualized services for its clients, while fostering business agility and scientific innovation. Rather than a centralized lab group, they are, by design, a network of empowered entrepreneurs, each running their business with a high degree of autonomy.

It is important to understand that it is a business with which operational efficiency is gained by increasing scale.

3. Main competitors

The company, as has been seen, operates in many sectors and with different activities within it, so finding an identical comparable is difficult. Perhaps the most similar companies would be Intertek, Bureau Veritas, Labcorp and SGS. All of those companies had CAGRs between (6,5%-10,5%) in the period 2009-2022.

In more specific sectors Eurofins would have a wide variety of competing companies (Thermo Fisher Scientific, Danaher, Charles River, BioMérieux, Addlife,…).

4. Management Team.

The CEO and founder of Eurofins is Gilles Martin.

Originally, Martin's parents had patented a process for measuring sugar levels in wines, and entrusted their Gilles and his brother Yves-Loïc with the development and marketing of the process. The company's was launched in 1987. Gilles bought the patent from the Scientific Research National Center (CNRS), discovered new applications for the patent, and expanded the company's clientele to the entire food industry. The company quickly reached 50 employees and exported 70% of its production. Eurofins then proceeded to massively buy out other laboratories, including by financing laboratories in start-up mode.

Gilles Martin owns about 33% of Eurofins' capital through the family's holding company Analytical Bioventures. His fortune is estimated to be $5.2 billion.

So the company has "skin in the game," which is desirable for long-term investors.

5. Performance in markets since its IPO (1997-2022).

Eurofins joined the CAC 40 index and has been for over two decades one of the fastest growing listed European companies. Since its IPO, Eurofins’ revenues have increased by 32% each year (in compound average) to reach €6.7 billion in 2022.

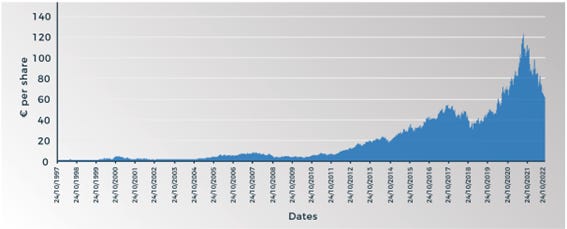

Furthermore, in the 25 years since its IPO to October 24th 2022, Eurofins has delivered a remarkable total shareholder return (reflecting both share price appreciation and reinvestment of dividends) of around 36,600%, equivalent to a compounded annual growth rate (CAGR) of nearly 27%.

1997-2007 - Eurofins had delivered a total shareholder return of 3200%

1997-2012 - Eurofins had delivered a total shareholder return of 5108%.

1997-2017 - Eurofins had delivered a total shareholder return of 30,000%.

(Imagen obtained from “Eurofins: 25 years of shareholder value creation. Analyst hire”. The image shows the adjusted price per share for the 2000 and 2020 share splits of 10 for 1 and the French Franc to Euro conversion).

6. Testing and laboratory analysis industry.

The spectrum of businesses and market niches is very broad, so it is impossible to establish a growth rate. There are parts of the business that are very mature with growth rates of 4% or less, but there are niche markets with growth rates above 25%.

As a reference I could cite, the global clinical laboratory tests market size was estimated at USD 103.67 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 9.4% from 2023 to 2030.

The clinical laboratory tests market is witnessing growth due to factors such as the rising geriatric population, the growing prevalence of target diseases, and the introduction of innovative solutions to meet the growing demand of the market for clinical tests.

7. Brief quote of competitive advantages

It is important to highlight that Eurofins is a business with several competitive advantages such as:

scale economics

good company culture

low-cost products

customer-critical products

network effect

8. Main figures of the business and its evolution.

Revenues (Eur in million):

Net earnings and net profit margin (Eur in million):

EBITDA (Eur in million):

Free cash flow and margin FCF (Eur in million):

9. Comments on recent results and what concerns Mr Market.

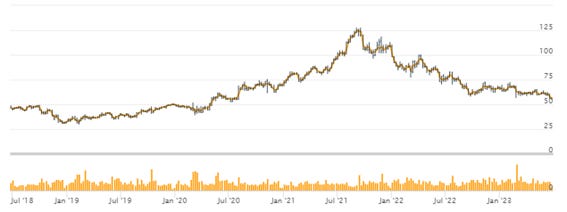

Mr. Market exaggerated the valuation of Eurofins due to the temporary increase in sales due to COVID. But recently it has already been adjusting the valuation due to:

First, because the market realized that sales due to the covid test would be temporary.

Second, because the market considered that the different real estate acquisitions, that Eurofins was contemplating making would not be efficient with the use of capital.

And others like the fact that Eurofins has also been affected to a lesser extent by cost increases, the war in Ukraine,…

Eurofins has seen a 55% drop in its valuation from its highest price (Imagen from TIKR.com).

9.1 In relation to the concern about the temporary post-covid drop in sales.

In the previous section "main figures of the business" you can see the effect of the temporary sales of the covid. As EBITDA, free cash flow, margins,... increased in 2020 and in 2021 compared to 2019. You can also see the decline in the main business figures if you compare 2022 with 2021.

2022 Revenues were stable on a reported basis vs FY 2021 despite the year-on-year decrease in revenues from COVID-19 testing and reagents of more than €800m.

Revenues in the Core Business (excluding COVID-19 testing and reagent revenues) increased by +5.8% organically in FY 2022.

Due to lower COVID-19 testing volumes, revenues from COVID-19 testing and reagents declined year-on-year by more than €800m (to just under €600m in FY 2022 from over €1,400m in FY 2021).

Other aspects that have affected the business:

Inflationary headwinds for personnel expenses, energy, logistics and consumables and lagging corresponding price increases by Eurofins companies

Others as Labour-related effects such as strikes, volume challenges faced by some of their clients following the start of the war in Ukraine.

Despite this, if we discount the effects of the covid, the business continued to grow, and nothing got worse.

9.2 In relation to the concern about the real estate acquisitions.

Recently acquisitions:

In 2022, Eurofins added more than 78,000 m² of laboratory, office and storage space through the delivery of building projects, building acquisitions, new leases and consolidation of sites, plus 76,000 m² of buildings which were already part of companies added through acquisitions in the M&A scope, comprising a total of over 150,000 m². The net floor area of Eurofins-owned premises has increased by 27% (104,000 m²) vs 2021 to reach 490,000 m², 70% of the building area added by Eurofins in 2022 is owned by Eurofins (vs 58% for the period 2018-2021).

Since 2018, the net floor area of buildings owned by Eurofins has more than doubled from 240,000 m² to 490,000 m². Furthermore, 28,000 m² of Eurofins current sites were renovated in 2022 to bring them to the highest standard. Out of the total net floor area increase, 21% can be attributed to the Asia Pacific region, expanding the growth platform for a region that today represents only 9.5% of Eurofins revenues.

Upcoming acquisitions for 2023 and 2024:

From 2023, Eurofins plans to invest around €200m p.a. to build and purchase (both new and currently rented) laboratories. Investments in 2023 and 2024 are expected to contribute a total net floor area of ca. 140,000 m² (40% to be delivered in 2023 and 60% in 2024). Eurofins is committed to continue to invest significantly in its infrastructure to build the largest, most modern and most efficient laboratory network in its industry.

The market is concerned about the current capital allocation in real estate, but Eurofins already began acquiring real estate years ago with more attractive interest rates than today.

The acquisitions are being made at certainly compelling financial valuations, and the management team sees ownership of the site as key to reducing risk and reliance on homeowners and unlocking economies of scale.

9.3 Strength of your balance.

Eurofins’ balance sheet remains very strong:

The financial leverage (net debt to adjusted pro-forma EBITDA) was 1.9x at the end of December 2022. Including the issuance of €600m of hybrid bonds in January 2023 and the planned repayment of the outstanding €183m of hybrid bonds callable on 29 April 2023, Eurofins’ pro forma financial leverage is 1.6x, at the lower end of our targeted range of 1.5-2.5x.

Outside of the planned repayment of the hybrid bonds callable on 29 April 2023, Eurofins has no major financing requirements until the outstanding €448m senior Eurobonds become due on 25 July 2024.

9.4 Share buyback plan.

Share buyback plan:

The 1st tranche of a share buy-back programme that repurchased 121,493 shares was completed on 3 December 2022. It is currently intended that all purchased shares may be used as previously communicated, including to cover the Company’s Long-Term Incentive plans as approved by the Board of Directors at its meeting on 19 December 2022.

A 2nd tranche was launched 22 December 2022 and will run until 3 May 2023 (extended from 3 March 2023). It will cover a maximum volume of up to one million shares or 0.52% of the Company’s current share capital.

9.5 Dividend.

In 2023, the annual dividend will be of €1.00 per share, corresponding to 33% of FY 2022 reported Basic EPS.

9.6 Latest acquisitions.

Acquisitions in 2022:

59 acquisitions were closed (2021: 38), contributing €150m to consolidated revenues (€269m had the effective dates of these acquisitions been 1 January 2022). The cost of these acquisitions was €430m, equivalent to only 1.6x of their FY 2022 revenues. Indeed, Eurofins focussed on reasonably valued smaller bolt-on acquisitions.

Start-ups have been launched in all key areas of activities and regions of the Group, including 50 new start-up laboratories and 18 new blood collection points (BCPs). The mature start-ups created between 2010 and 2021 generated return on capital employed of more than 45% on revenues of €239m.

10. Plans, future, and expectations.

Eurofins has updated its targets for fiscal year 2023 to fiscal year 2027 (In 2022 the free cash flow before investment in owned sites of €677m):

Main objectives:

In FY 2023 and to FY 2027, Eurofins targets organic growth of 6.5% p.a. and potential revenues from acquisitions of €250m p.a. Continued growth investments in the ownership of strategic sites, start-ups and bespoke proprietary IT solutions are expected to drive increased profitability and cash generation over the mid-term horizon.

These objectives assume exchange rates are stable vs 2022 average and zero contribution from COVID-19 testing and reagents.

With the aim of launching 30 new start-up laboratories (50 in FY 2022) and several new BCPs (18 in FY 2022) in FY 2023, Eurofins expects Separately Disclosed Items (SDI) at the EBITDA level to be about €100m in FY 2023 and decline thereafter toward less than 0.5% of revenues.

Capital allocation priorities in FY 2023 and the mid-term will continue to include site ownership of high-throughput campuses to complete Eurofins global hub and spoke network, start-ups in high growth areas, development and deployment of sector-leading proprietary IT solutions and acquisitions. Investments in these areas are key to our long-term value creation strategy. From FY 2023, investment in owned sites is assumed to be around €200m p.a., while net operating capex is expected to be ca. €400m p.a. (total net capex of €600m p.a.).

Eurofins targets to maintain a financial leverage of 1.5-2.5x throughout the period and less than 1.5x by FY 2027.

The speed of improvement toward the 2027 adjusted EBITDA margin objective will depend on the timing of the bottoming out of food and consumer product end markets and how fast pricing can be aligned to cost inflation as well as the speed of execution of innovation, productivity, digitalization and automation initiatives.

Business valuation.

2023 Valuation based on the guide:

Market cap (today) = 10710 M eur

Revenues = 6650 M eur

Ebitda (Adj) = 1375 M eur

Net Debt = 2833 M eur

Free cash flow = 725 M eur (FCFF before investments in owned sites)

Enterprise value/ FCFF = 18,68

Unlevered free cash flow yield = 5,35%

EV/EBITDA = 9,85

NET DEBT/EBITDA = 2,06

%margin ebitda = 20%

2027 Valuation based on the guide:

Market cap (today) = 10710 M eur

Revenues = 10000 M eur

Ebitda (Adj) = 2400 M eur

Net Debt = 3360 M eur (Estimated 1,5 Debt to Ebitda)

Free cash flow = 1500 M eur (FCFF before investments in owned sites)

Enterprise value/ FCFF = 9,38

Unlevered free cash flow yield = 10,66%

EV/EBITDA = 5,86

%margin ebitda = 24%

If a pricing study of the company is carried out, it can be seen that it would be reasonable to value Eurofins at multiples of:

EV/EBITDA = 14x or 16x

EV/FCFF = 20x or 22x

Therefore, I could estimate the value per share in 2027 at around 120-135 eur/share. If I carry out a discounted cash flow valuation, we would obtain a similar valuation.

Today's value is 56-57 eur/share.

Therefore, we have growth, competitive advantages, quality and value in a single company. Perhaps the market can further lower its valuation and make it more attractive, but today it is already a very good option.

“Quality is under appreciated. It cannot be modelled in Excel, it’s not on the balance sheet, nor does it make for an exciting investment pitch. Quality is not easy to pin down, because it often represents new ways of doing things that stretch or break old mental models.” Josh Tarasoff

This article is not a stock buy recommendation. (Company information has been obtained from annual reports, and TIKR.com).

It's nice to (finally) see another investor interested in this company! The interest on e.g. Twitter is so nonexistent that I always wonder if I'm the idiot in the room for liking the company.

To me their strategy (real estate purchases, automation) make total sense! What I'd like to understand better is their runway outside food/pharma testing (because I don't see their business 10x in those areas).