Diageo PLC (LON:DGE).

Pricing power, secular growth, competitive advantages and quality. Drink better, not more quantity.

1. Introduction to Diageo (LON:DGE).

Diageo PLC is the world’s leading premium drinks business with an outstanding collection of international brands across spirits, wine and beer. Trading in approximately 180 markets, Diageo employs over 20,000 people with offices in 80 countries and manufacturing facilities around the globe.

Diageo, together with its subsidiaries, produces, markets, and sells alcoholic beverages. The company offers scotch, whisky, gin, vodka, rum, ready to drink products, raki, liqueur, wine, tequila, Canadian whisky, American whiskey, cachaca, and brandy, as well as beer, including cider and non-alcoholic products.

Diageo was created in 1997 when Guinness merged with food and beverage wholesaler Grand Metropolitan PLC. The deal was for $15.8 billion. [$15.8 billion was a record amount at the time, making the company the seventh-largest drinks and food holding organization globally].

About Guinness Brewery.

The father of Arthur Guinness, born in 1725, was a brewer. He learned the trade from him and established his brewery in Celbridge. In 1759, he leased an acre and a half of land near St. James's Gate on River Liffey in Dublin for 9,000 years. Pale and ale beers were not very popular in Ireland; whiskey and gin were, on the other hand, much more common, so he decided to make black beer. He created his black beer using secret ingredients, and it was a huge success.

In 1868, it was among the first three major breweries, with more than 350,000 barrels. By 1876, it had produced nearly 780,000 barrels. In October 1886, Guinness became a public company with average sales of over one million barrels per year. The company was worth £6 million at the time and the shares were oversubscribed twenty times the issue price, so the share price immediately rose 60% on the first day of trading.

In 1914, the company had sold over 2.5 million barrels of beer, representing 10% of the British market at the time.

In 1930, it was one of the seven largest companies in the world.

In 1986, the company was renamed Distillers Company, which also made it a controlling body in the United Kingdom.

About Grand Metropolitan PLC

1934. MRMA ltd is incorporated as a public company (as a hotel business).

From the accommodation market, it was a natural step forward to open toward catering.

In 1967, it acquired Bateman Catering and Midland Catering.

In 1967, it acquired Express Dairies, Berni Inns, and Mecca bingo halls.

In 1972, it entered the brewing business by purchasing Truman, Hanbury & Buxton, Watney Mann.

With these new acquisitions, the group held onto quite a few alcoholic beverage brands, including J&B whisky, Baileys Irish Cream, Gilbey's gin, Piat wine, and Croft sherry, and Smirnoff vodka. To reflect the change in direction and the rapid expansion of the company, it was renamed Grand Metropolitan in 1973.

The 1980s saw a lot of M&A and divestment activities for the Grand Met.

It acquired US tobacco and drinks company Liggett Group, which was later sold to Bennett S. Lebow.

Warner Holidays and Intercontinental Hotels Corporation were bought

In 1987 acquisition of Heublein wines and spirits from RJR Nabisco, Grand Met became one of the largest producers of wine and spirits in the world.

In 1988 Through the buyout of the Pillsbury Company and its Burger King chain, Grand Metropolitan entered the fast food industry, later acquiring the Wimpy chain.

Haagen-Dazs ice cream and Green Giant vegetables were also part of Grand Metropolitan.

Diageo was created in 1997 although it was not until 2002 when it acquired its current name with the aim of focusing its activity on premium beverages.

In 2000, Diageo sell Burger King and Pillsbury to focus on its fast-growing alcoholic drinks market. It bought Seagram's drinks unit at the end of 2001.

Although Diageo was founded in 1997, its brands date back much earlier, some as far back as the 17th century.

Comments on the history of the oldest major brands:

Haig Club Scotch Whisky is built on nearly 400 years of distilling heritage and the House of Haig can trace its whisky producing roots back to the seventeenth century. In 1824 John Haig established the Cameronbridge distillery and it was there that he pioneered the art of producing grain whisky in continuous Coffey and Stein stills - an invention which laid the foundations for the growth and success of the modern Scotch Whisky industry. Haig Club is born of that Haig family legacy of innovation and excellence in whisky making.

Guinness Beer. Arthur Guinness was the first in a long line of Guinness Brewmasters, and the art of brewing at the St. James's Gate Brewery was passed down through the generations. On December 31, 1759, Arthur Guinness signed a 9.000 year lease for St. James's Gate Brewery in Dublin. If that's not faith, we don't know what is.

Johnnie Walker Whisky. In 1820, the young farmer’s son started his own grocer’s shop in the thriving town of Kilmarnock. His father had died the year before and the farm sold. He wanted his customers to enjoy the same quality and flavor time after time. So he began mixing them together until he produced a whiskey that he was proud to name after himself. Today it is the most widely distributed brand of blended Scotch whiskey in the world, sold in almost all countries.

Tanqueray Gin. Back in the 1830s, Charles Tanqueray was not afraid to mix up brave ideas in his own unique style. He invented gins with different flavorings.

Smirnoff’s Vodka. In 1864, Pyotr Smirnoff opens a distillery in Russia and begins making vodka using a revolutionary charcoal filtering process. Smirnoff fled from Russia during the Revolution and re-established the brand in Europe in the early 1920s.

Crown Royal Whisky. First created in 1939 by Sam Bronfman as a gift for the visiting King George VI and Queen Elizabeth. King George VI and Queen Elizabeth were the first reigning monarchs to visit Canada and Bronfman, a Canadian spirits entrepreneur, meticulously trialled more than 600 blends before he was happy with the final product.

Baileys Original Irish Cream Liqueur created in 1974.

2. Business model

The company distil, brew, bottle and distribute its spirits and beer brands through a globally coordinated supply operation, working to the highest quality and manufacturing standards. Where it makes sense, they produce locally. Diageo is organized in a model based on the market, this mean that it is more agile and can better apply it’s strategy to the various needs of the company’s customers in individual countries.

One of the most important keys is the deep knowledge of local markets. It also enables to quickly identify and act on consumer trends to support growth. The company use the local and global market expertise to identify and deliver against the most value growth opportunities. Global supply capabilities enable to manufacture and distribute brands efficiently and effectively.

Main columns of the business model.

1. Brands. The company has a leading portfolio of iconic brands (>200 brands). Its breadth across categories and price points offers choice for every taste and celebration.

2. Relationships. From grain to glass, strong, trusted relationships with all stakeholders are essential to your business. (>180 countries)

3. Insight and know-how. Sales and marketing teams in different countries provide them with greater agility and better knowledge, so that the company can anticipate the diverse needs of its consumers and customers.

4. Infrastructure. The company has a global network of sites devoted to research and development, distillation, maturation, brewing, warehousing and packaging of spirits and beer. (>132 sites globally).

5. Financial strength. The company is focused on maintaining and growing margins and free cash flows, as well as having a strong balance sheet that provides the financial strength to execute on its strategic priorities and generate strong long-term shareholder returns.

It is important to understand that it is a business with which operational efficiency is gained by increasing scale.

3. Global reach and position.

Below are the top 10 beverage companies in the world ordered by sales volume (Considering all kinds of drinks):

If we take into account the above list includes companies that sell water, soft drinks, beer in general, coffee,... it can therefore be concluded that Diageo is the world’s leading premium drinks business.

4. Industry analysis and trends.

Volume growth in the global beverage alcohol market is expected to slow to +1% per annum over 2023-2027, according to the latest analysis from IWSR. The United States and China remain key to industry value growth. But India, Mexico and Brazil will be the key to industry volume growth drivers.

The fact that the global market does not grow does not mean that certain markets can grow. And the same with products, certain premium brands or new more refined products can grow at great rates.

The global spirits market grew from $143 billion in 2022 to $153 billion in 2023 at a compound annual growth rate (CAGR) of 6.9%. And the global spirits market is expected to grow to $193 billion in 2027 at a CAGR of 5.9%.

According to the latest analysis from IWSR, RTD category volumes across the 10 main markets will grow 15% CAGR (RTD=ready to drink beverages).

The premium Scotch Whiskies market is expected to grow at a CAGR of 6.5% to 2026.

The premium International Whiskies market is expected to grow at a CAGR of 6.5% to 2026.

The premium tequila market is expected to grow at a CAGR of 10% to 2026.

The premium vodka market is expected to grow at a CAGR of 9% to 2026.

The premium liqueurs market is expected to grow at a CAGR of 10% to 2026.

The premium rum market is expected to grow at a CAGR of 10% to 2026.

Trend of spirits, and more specifically of premium brands.

Healthy TBA growth with spirits growing faster driven by premiumisation.

Spirits share of TBA in 2010 was 31%. Spirits share of TBA today is 41%. (TBA = Total beverage alcohol).

Beer/Malt share of TBA in 2010 was 51%. Beer/Malt share of TBA today is 42%.

Spirits RSV growth by price point CAGR 2010-2021: +1% value product, +7% value product, +8% premium product, +15% super-premium product.

It is important to differentiate, on the one hand, the growth in sales volume from the growth in prices.

As I mentioned before, one of the most important keys is a deep knowledge of local markets. It also allows you to quickly identify and act on consumer trends to support growth. I summarize the trends below:

Consumers are seeking new experiences and higher quality products. The consumers want ‘drinking better, not more’. Consumers are increasingly choosing brands and categories that offer superior quality, authenticity, and taste. This premiumization trend is supported by product innovation.

According to several reports of IWSR: “Higher price spirits tiers grew 7 times faster than the total spirits category for the period 2011 to 2021”.

Consumers who drink alcohol are increasingly choosing spirits over beer and wine. This is a long-term trend that is happening all over the world. In markets where spirits are a less mature category, leading spirits brands can offer quality and affordability.

Global economic development is driving the emergence of consumers with higher disposable income.

Spirits penetration in many emerging markets is still low when compared with developed markets, providing the potential for additional growth.

Consumers in developed markets are moving towards lower-tempo, food-related occasions. As the on-trade has reopened following the pandemic, high-tempo, late-night occasions are recovering. However, the long-term shift towards occasions before, during and after meals, and in choices that suit ‘at home’ occasions, persists.

Digital and technology are changing the way consumers find and buy their beverages. Online alcohol purchases are still low compared to other retail categories but continue to be a fast-growing channel that has accelerated dramatically during the pandemic.

5. An in-depth look at the company.

5.1 Brief quote of competitive advantages.

It is important to highlight that Diageo is a business with several competitive advantages such as:

Economies of scale in advertising, data analytics, distribution, manufacturing, research and development and procurement of ingredients. Lower average costs mean competitive pricing and higher margins.

Good company culture.

Brand power. Positive brand equity allows you to charge more for your product or service.

For the final customer. Spirits variants are distinguishable in terms of flavors, provenance, production process, and vintage. Such points of differentiation allow distillers to charge higher prices for luxury categories. Johnnie Walker’s 18-years-toproduce Black Label scotch, for instance, sells at 3.7 times the price of Johnnie Walker Red Label whisky.

Better access to distribution channels. Bars, bottle shops, pubs, restaurants, and supermarkets have finite space to display drinks. They prefer brands that sell quickly and deliver higher margins.

5.2 Position of your brands.

If we focus on the premium beverage and spirits sector in the world, the main competitors and their market share are companies as: Pernod Ricard, Brown-Forman, Constellation Brands, Suntory, Molson Coors, Bacardí….

There are numerous small market niches, companies that operate only in some sectors within spirits...so to make a comparison and see their position in their different markets, it seems to me best to see the position of their main brands.

Therefore, I will first break down the company's sales by different types of products and by region, and then I will show the position of its products against its competing brands.

Diageo company revenues breakdown. % revenues by product type in first half of fiscal 23:

Scotch whiskey 27%

International whiskey 12% (Other whiskies: Irish, Canadian, Japanese,…)

Beer 14%

Tequila 11%

Vodka 9%

Gin 5%

Liqueur 5%

Rum 5%

Other 12%

Diageo company revenues breakdown: % net sales in first half of fiscal 23 by region in first half of fiscal 23:

37% North America. (+3% organic net sales grew).

21% Europe. (+10% organic net sales grew).

20% Asia Pacific. (+17% organic net sales grew).

12% Latin America and Caribbean (+20% organic net sales grew).

10% Africa. (+6% organic net sales grew).

Top 5 biggest-selling Scotch whiskies. Listed in order of their nine-litre-case sales.

Johnnie Walker. Diageo-owned. (+18.6% sales y/y). Sales 22.7mill

Ballantine’s. (+5.5% sales y/y). Sales 9.2mill

Chivas Regal. (+26.0% sales y/y). Sales 5.2mill

Grant’s. (+2.2% sales y/y). Sales 4.2mill

Black & White. Diageo-owned. (+14.5% sales y/y). Sales 3.6mill

Diageo leads the Scotch Whiskies with a value market of 39% (Peer 1: 20%; Peer 2: 8%, Peer 3: 7%, Others 26%).

Top 4 best-selling world whisky brands (not included Scottish Whiskey).

Jim Beam (-1.6% sales y/y). Sales 16.7mill

Jack Daniel’s (+7.9% sales y/y). Sales 14.6mill

Jameson (+15.1% sales y/y). Sales 11.1mill

Crown Royal. Diageo-owned. (-5.9% sales y/y). It will increase sales in 2023 and open a carbon neutral distillery in Canada.

Diageo leads the International Whiskies with a value market of 25% (Peer 1: 16%; Peer 2: 11%, Peer 3: 10%, Peer 4: 5%, Peer 5: 4%, Others 29%).

Top 4 biggest-selling Tequila brands.

Jose Cuervo (+15.9% sales y/y). Sales 9.2mill. Previously owned by Diageo.

Patron (+10.1% sales y/y). Sales 3.5mill

Don Julio. Diageo-owned. (+16.9% sales y/y). Sales 3.2mill

Casamigos. Diageo-owned. (+42.5% sales y/y). Sales 3.2mill.

Diageo have more than doubled US market since 2019 (from 10% to 22.4%).

Diageo sold Jose Cuervo. This operation, which involved the payment to Diageo of 408 million dollars, also included the right of this company to distribute Smirnoff in Mexico, and to own 100% of Don Julio tequila.

Top 3 biggest-selling vodka brands.

Smirnoff. Diageo-owned. (+6.0% sales y/y). Sales 28.1mill

Absolut (+10.7% sales y/y). Sales 13.0mill

Żubrówka (-2.9% sales y/y). Sales 10.5mill

Top 8 biggest-selling gin brands.

Gordon’s. Diageo-owned. (+3.6% sales y/y). Sales 7.7mill

Bombay Sapphire. (+28% sales y/y). Sales 5.7mill. Previously owned by Diageo.

Tanqueray. Diageo-owned. (+0,0% sales y/y). Sales 5.5mill

Beefeater. (+15.5% sales y/y). Sales 3.8mill

Seagram’s. (+2.5% sales y/y). Sales 2.5mill

Hendrick’s. (+17.9% sales y/y). Sales 1.6mill

Larios. (+23.1% sales y/y). Sales 1.5mill

Gilbey’s. Diageo-owned. (+14% sales y/y). Sales 1.2 mill

Top 2 biggest-selling liqueurs.

Bailey’s. Diageo-owned. (+0.2% sales y/y). Sales 8.8mill

Malibú. (-1.8% sales y/y). Sales 4.9mill

Top 4 best-selling rum brands.

Tanduay (+16.1% sales y/y). Sales 27.4mill

Bacardí (+10.4% sales y/y). Sales 23.4mill

Captain Morgan. Diageo-owned. (+1.9% sales y/y). Sales 12.9mill

McDowell’s Rum. Diageo-owned. (+5.1% sales y/y). Sales 8.8mill

The company has a leading portfolio of iconic brands (>200 brands). Diageo has a perfect mix between big brands that dominate the market due to volumes and good profitability, but also small brands with small volumes but very large growth rates.

I recommend the following web page to keep up to date with the sector, in addition to the great value that its articles provide. It has helped me to consult and synthesize a lot of information: www.thespiritsbusiness.com

5.3 The growth in sales of 2022.

Growth by product categories:

Category spirits grew 21%, with broad-based growth across categories, and particularly strong performance in scotch, tequila, vodka, gin and Chinese white spirits.

Scotch whisky. 24% of Diageo’s reported net sales and grew 29%, led by Johnnie Walker up 34%, with both growing strong double digits across all regions.

Johnnie Walker Black Label grew 39%, with double-digit growth across all regions.

Johnnie Walker Blue Label grew 63%, with growth across all regions, particularly North America and Asia Pacific.

Johnnie Walker Red Label grew 22%, with double-digit growth in Europe, Latin America and Caribbean, and Asia Pacific, partially offset by a decline in North America.

Scotch malts grew 17%, primarily driven by strong growth in Asia Pacific and Europe.

Primary scotch brands grew 14%, primarily driven by double-digit growth of Black Dog and Black & White in India.

Tequila. 10% of Diageo’s reported net sales and grew 55%, with Don Julio and Casamigos continuing to gain share of the fast-growing tequila category within the US spirits market.

Vodka. 10% of Diageo’s reported net sales and grew 11%, with growth across all regions, particularly Europe.

Smirnoff net sales increased 10%, with double-digit growth in all regions, except North America, where net sales declined.

Ketel One grew 16%, primarily driven by North America, with double-digit growth in the core variant.

Cîroc grew 6%, with strong growth in Europe. Net sales were broadly flat in North America, lapping double-digit growth in fiscal 21, with growth from recent innovations more than offset by declines in other variants.

Canadian whisky. 7% of Diageo’s reported net sales and grew 6%.

IMFL whisky. 4% of Diageo’s reported net sales and grew 7%.

US whiskey. 2% of Diageo’s reported net sales and grew 14%

Rum. 5% of Diageo’s reported net sales and grew 6%.

Captain Morgan grew across all regions except North America, with particularly strong growth in Europe.

Zacapa grew in all regions, particularly in Europe.

Gin grew 18%, primarily driven by strong double-digit growth in Europe, Africa and Latin America and Caribbean. Tanqueray and Gordon’s both grew double digits.

Liqueurs. 5% of Diageo’s reported net sales and grew 10%

Growth was driven by Baileys Original in Europe and Latin America and Caribbean.

Category beer. 16% of Diageo’s reported net sales and grew 25%, primarily due to the strong recovery of Guinness, up 32%, driven by Ireland and Great Britain as on-trade restrictions eased, as well as double-digit growth in Africa.

Category ready to drink. 4% of Diageo’s reported net sales and grew 18%, with double-digit growth across Europe, Africa, Latin America and Caribbean and North America.

In 2022, Diageo accounted for a highly impressive 21 of the top 100 brands in its Largest Growing Brands list.

5.4 Main areas where the company will focus with a long-term vision.

Focus on diversified footprint and quality growth:

With only 4.6% of global TBA share, Diageo believe they have significant headroom for sustainable, long-term growth, and its ambition is to outperform the market and increase our TBA value share to 6% by 2030. (TBA = Total beverage alcohol).

Leveraged RGM in challenging inflationary environment, upweighting strategic pricing capabilities.

Expansion of all portfolio and focus in ready to drink portfolio.

Launched no-alcohol portfolio in additional markets.

Diageo is increasing its position in the fast-growing businesses in India and China. In addition, Diageo is maintaining and slightly increasing its leadership position in the US international spirits market.

Diageo has a well-balanced position between developed and emerging markets, gives exposure to the largest consumer growth opportunities while providing some resilience to global volatility.

Spirits penetration remains low and even in our largest market, the United States, only around 50% of households purchase spirits every year.

An additional 600 million consumers are expected to come of age by 2032, and the continued growth of the ‘middle class and above’ income bracket should enable 600 million more consumers to access our brands.

Focus on premiumisation:

Advantaged portfolio with strong brands underpinned by favorable industry trends of premiumization.

Portfolio has been positioned owards fast-growing categories.

Premium-plus brands contributed 57% of reported net sales and drove 65% of organic net sales growth.

Our super-premium-plus portfolio of luxury brands grew 31% this year, contributing 27% of its reported net sales.

As the premiumisation trend evolves, so too has the idea of luxury.

Reported net sales by Diageo by segment price (£bn) H1 2019 vs H1 2023:

Value segment: 0.6 vs 0.6.

Standard segment: 2.7 vs 3.4.

Premium segment: 2.3 vs 2.8.

Super premium segment: 1.3 vs 2.6.

Super premium net sales growth by region % H1 2022 vs H1 2023

North America 10%

Asia Pacific 13%

Europe 13%

Latin American and Caribbean 28%

Africa 21%

Focus on efficiency:

Continued to scale efficiencies by embedding a new operating model across global supply and procurement.

Continued to improve process controls in supply operation to reduce waste, optimise the use of raw materials, and unlock efficiencies through the introduction of additional automation.

Optimize the supply chain costs.

Focus on strengthening the supply chain. (Initiate supply chain agility programme).

Focus on digitalization:

Accelerate the transformation and integration of your digital capabilities, tools and platforms across marketing and global sales.

Continue investment in data analytics and automation.

Continued progress in delivering Society 2030 ESG goals.

Build loyalty relationships with suppliers of raw materials (barley, agave, wheat, maize, sugar/molasses, grapes,…). The supply of raw materials depends on weather conditions and being a large-scale customer with a long-term vision is key.

5.5 Acquisitions and orientation of the brand portfolio.

The portfolio management has been shaped it towards higher-growth categories, including tequila, international whisky, scotch and gin.

There are four classes of brand value ordered from highest to lowest:

super-premium plus brand

premium plus brand

standard brand

value brand

Since 2017, acquisitions by £2.2bn have been done as: Casamigos, Chase Destillery, Aviation American, Mezcal Union, 21 Seeds, Don Papa, Seedlip, Balcones Distilling, Vivanda, Mr Black…. These acquisitions have included acquisitions of premium-plus brands (6 companies) and super-premium plus brans (10 companies).

Since 2017, several disposal by £1.2bn have been done as: Archers, Picon, Cameron Brewery, USL Popular Brands, Meta Beer, Romana Sambuca, Booth’s Gin,…These disposals have included disposal of premium-plus brands (4 companies), super-premium plus brand (1 company), standard brand (13 companies) and value brands (36 companies).

The total acquired brands, since its founding, account 22% of total Diageo’s assets.

I have reviewed the valuations of various acquisitions and the future value created for the company and see that the capital allocation is correct.

Casamigos tequila as an acquisition case that might initially seem expensive.

Casamigos was founded by actor George Clooney along with entrepreneurs Rande Gerber and Mike Meldman in 2013. Even before Gerber and Clooney tried their luck in the liquor world, the two friends were already experts on tequila, which they often drank together at one of the two houses they built next to one another in Mexico. They called the property “Casamigos,” or “house of friends” in Spanish. Missing what they felt was a smoother option - a tequila that could be light enough to drink straight - Gerber and Clooney connected with their friend Meldman, and the three of them found a distillery in Mexico.

Casamigos was sold to Diageo for a whopping $700 million in 2017, with an additional $300 million deal for expansion over the next ten years.

Today the estimated value of the Casamigos brand is around $935 million, and it is still at a very high growth rate.

5.6 Share buyback plan.

Diageo return to shareholders through share buybacks:

Share buy-back programme F20-F23 £4.5bn.

New F23, up to £0.5b share buy-back programme.

Return of capital cumulative share buyback from 2018 to H1 2023 (£bn) = £8.5bn

5.7 Dividend plan.

Diageo has a track record of growing shareholder value, and have increased its full-year dividend per share every year since 2001, including during Covid-19. Over the last 20 years, its absolute dividend per share has increased 220%. The 5-year full year dividend CAGR +4.1%.

5.8 20-Year Annualized TSR.

Diageo has a 20-year annualized TSR of 12%.

5.9 Strength of your balance.

Diageo has a consistent and disciplined approach to capital allocation.

Leverage ratio policy. Adjusted net debt to adjusted EBITDA: 2.5x –3.0x. (Ratio of 2.5x as at 31 December 2022).

Return excess cash to shareholders: Organic growth, M&A and portfolio management, Dividends 1.8x to 2.2x.

5.10 CAPEX investments.

Diageo has increased its investment in CAPEX recently. Although historically it is already characterized by having a sustained investment in CAPEX.

In 2023 £1.0-1.2 billion* (expected).

In 2022 £1.1 billion*

In 2021 £0.6 billion

In 2020 £0.7 billion

In 2019 £0.7 billion

In 2018 £0.6 billion

(*) Invested £0.4-0.5 additional billion of capex in supply capacity, sustainability, digital capabilities, and consumer experiences.

The investments to sustain long-term growth have been increased:

Increased organic marketing investment by 6.8%, reflecting strong, consistent investment in your brands.

Additional invested £0.4 billion of capex in supply capacity, sustainability, digital capabilities and consumer experiences.

5.11 ROIC development.

The disciplined approach to capital allocation is driving steady improvement in ROIC while they significantly invest in long-term growth.

2022 ROIC 16.8%

2021 ROIC 13.5% (covid effect)

2020 ROIC 12.4% (covid effect)

2019 ROIC 15.1%

2018 ROIC 14.3%

2017 ROIC 13.8%

5.12 Intercorporate investments.

Diageo has investment in several small companies around the world. But, I will only mention the one that I consider the most important and relevant.

Diageo owns 34% of Moet Hennessy SAS (MH) and Moët Hennessy International SAS (MHI). [There are several significant agreements that contain certain termination rights and other rights for Diageo counterparties upon a change of control of the company. Under the partners agreement governing the company’s 34% investment in (MH) and (MHI), if a Competitor directly or indirectly takes control of the company (which would occur if such Competitor acquired more than 34% of the voting rights or equity interests in the company), LVMH Moët Hennessy – Louis Vuitton SA (LVMH) may require the company to sell its interests in MH and MHI to LVMH].

The personal valuation of Moet Hennessy according to sales or profit indicates by LVHM in its results for Moet Hennessy is:

Sales 2022: 7,100 bill € * 5x * 0.34 = 12,000 bill € = 10,280 bill £ (estimated)

Profit 2022: 2,155 bill € * 18x * 0.34 = 13,200 bill € = 11,308 bill £ (estimated)

Considering the Diageo’s market capitalization as 76500 bill £, the investment in Moet Hennessy is a 13,5-14,5%.

6. Main figures of the business and its evolution.

Revenues ($USD in million):

(Year 2016 with Brexit effect and Year 2020 with Covid effect)

(%Change in sales y/y in period 2003-2012)

Gross and operating margin:

(Gross and operating margin are maintained over the years).

Net earnings and net profit margin ($USD in million):

(Net margins are maintained over the years).

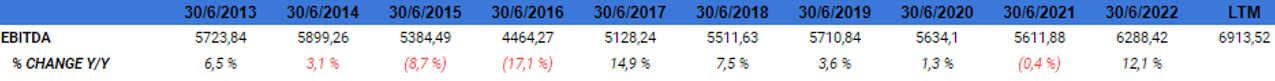

EBITDA ($USD in million):

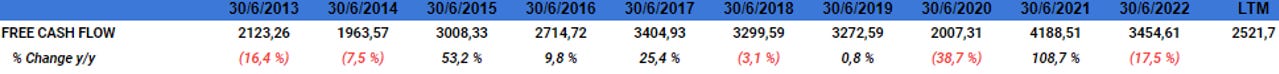

Free cash flow and margin FCF ($USD in million):

7. Valuation.

For the future valuation of the company I have considered the following:

the growth expectations by the company.

Guide provided by the company for the period 2023-2025.

New medium-term guidance 2023-2025: expecting organic net sales growth in a range of 5% to 7% and organic operating profit growth in a range of 6% to 9% for fiscal 23 to fiscal 25.

For the long term, the company indicates the following:

Introducing ambition to achieve a 50% increase in total beverage alcohol (TBA) market value share, from 4% in 2020, to 6% by 2030. [Keep in mind that the TBA market will grow, and that in order to gain more market share Diageo will have to grow faster].

the growth estimates of the market for the different sectors and product classes: value, standard, premium or super-premium. (Analyzed in section 4).

the breakdown of company sales by product type and its CAGR.

appropriate valuation multiples according to competitors (P/E = 25, EV/EBITDA =20, NET DEBT / EBITDA = 2.5, Gross margin 60%, Operative margin 30%, Net margin 20%):

Today Diageo's market price is 76,700 mill £, I have estimated that in 2030 the market price could be 200,000-210,000 mill £ (I think that is a conservative estimate). I don't like to think that everything will work out perfectly.

I consider that Diageo is a good investment idea to consider in current economic conditions because it offers a combination of inflation protection and secular growth. Therefore, we have growth, competitive advantages, quality and value in a single company. Perhaps the market can further lower its valuation and make it more attractive, but today it is already a very good option.

DISCLAIMER: This analysis is not a buy or sell recommendation, each person should do their own research before making any kind of investment.

(Company information has been obtained from the annual reports, and the following web pages have been consulted: TIKR.com, thespiritsbusiness.com).

Great article!

Interesting company, but I don't like the lack of insider ownership